Picture this: Baby boomers are turning 80 at a rate of 10,000 people per day, and they're not settling for their grandparents' retirement homes. The Senior Housing Boom 2026: Investment Opportunities in Wellness-Focused and Tech-Enabled Communities represents one of the most extraordinary investment landscapes in modern real estate history. With occupancy rates climbing toward 90 percent and supply struggling to keep pace with demographic demand, savvy investors are positioning themselves to capitalize on what industry experts are calling the investment opportunity of the decade.

This isn't your typical real estate cycle—it's a fundamental shift driven by demographics, changing lifestyle preferences, and technological innovation. As licensed brokers with over 15 years of experience analyzing market trends, we're breaking down exactly why the senior housing sector is absolutely so based right now, and how investors can tap into this fresh wave of opportunity before the market gets too crowded.

Key Takeaways

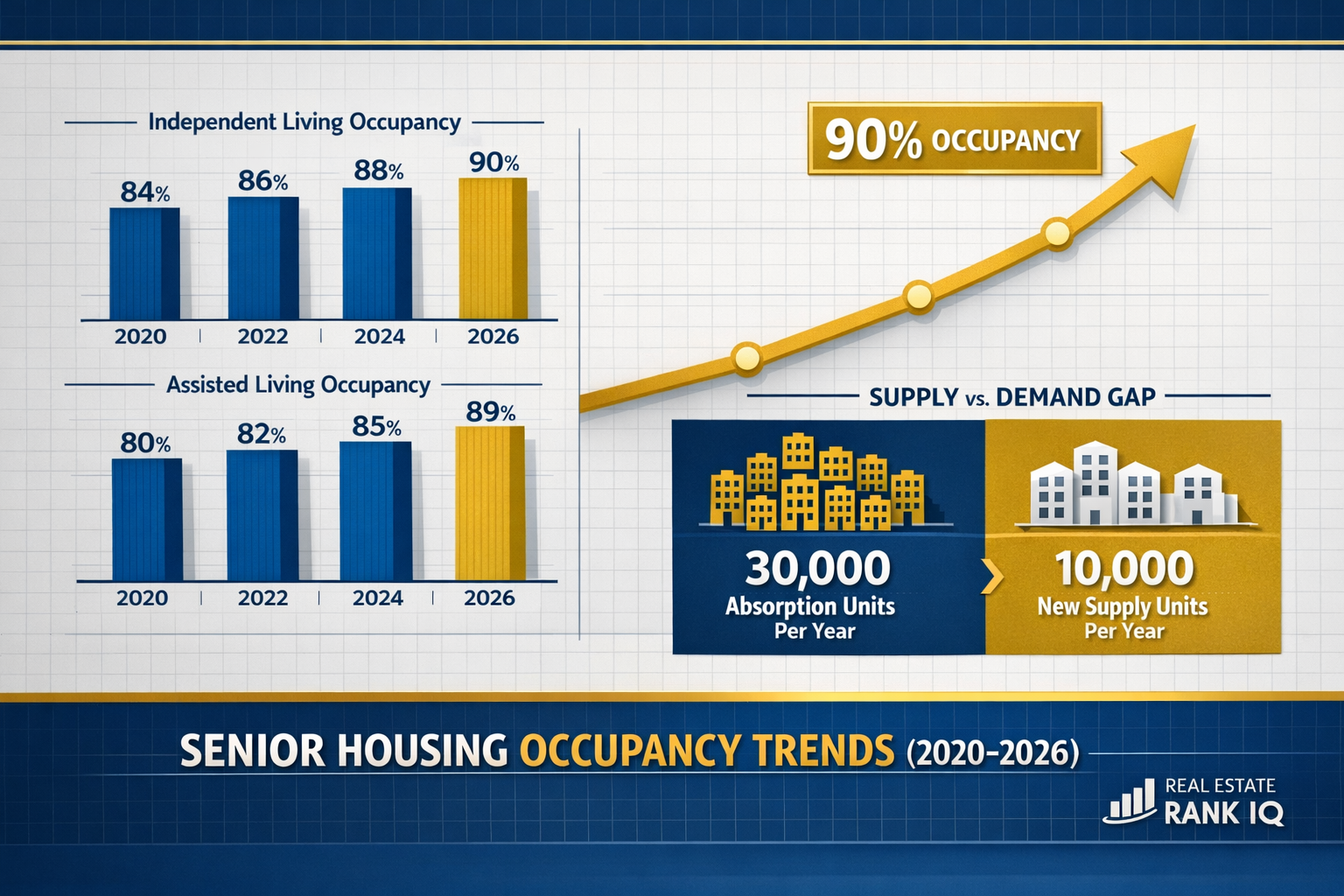

- Record occupancy rates approaching 90% across independent and assisted living communities signal unprecedented demand, with independent living exceeding 90% in 2026—the highest in 20 years of tracked data[1][5]

- Massive supply-demand gap creates investment urgency: absorption averages 30,000 units annually while new supply adds only 10,000 units, requiring development at twice historical maximums for the next 20 years[2][4]

- REIT investments are crushing it with same-store NOI growth hitting 20.4% in Q4 2025, while M&A activity reached record levels driven by cap rate compression and portfolio optimization[2][4]

- Wellness-focused and tech-enabled communities command premium pricing and faster lease-up, as residents prioritize lifestyle amenities, social connection, and smart home integration over traditional medical-focused environments[3]

- Independent living is outpacing assisted living by significant margins, reflecting earlier move-ins and changing consumer preferences that extend average length of stay and improve revenue visibility[3]

Understanding the Senior Housing Boom 2026: Market Fundamentals Driving Growth

Let's let it cook on the data for a moment, because the numbers tell an impeccable story. Senior housing occupancy is approaching historic highs, with independent living exceeding 90 percent and assisted living rising toward pre-pandemic levels in 2025[1]. Industry-wide occupancy is expected to approach 90 percent in 2026, which according to NIC MAP data could represent the highest occupancy rate in 20 years of tracked data[5].

The Supply-Demand Equation That's Gatekeeping Returns

Here's where things get wild: absorption has averaged over 30,000 units annually during the past four years while new supply increased by just over 10,000 units annually[2]. Translation? For every three seniors looking for housing, only one new unit is being built. Seniors housing completion levels have fallen by 73% since 2021[2], creating what industry analysts are calling a critical "investment gap" widening toward crisis levels.

The math is sobering: The senior housing industry would need to develop new communities at twice its maximum historical pace annually for the next 20 years just to maintain 90% occupancy given current demand[4]. Some markets are actually seeing units contract as owners convert communities to other uses or close them at rates higher than new communities opening[4].

Why this matters for investors: Scarcity drives value. When demand consistently outstrips supply, rental growth remains stable and pricing power increases. Speaking of which…

Rental Growth and Pricing Power

Rental growth remains stable at over 4 percent annually across both independent and assisted living, reflecting consistent pricing power in a balanced market rather than rapid volatility[1]. This isn't the boom-bust cycle we've seen in other real estate sectors—it's steady, predictable growth backed by demographic certainties.

For investors looking to understand broader real estate market trends and investment opportunities, the senior housing sector offers a compelling contrast to more volatile residential and commercial segments.

Transaction Volume and M&A Activity

Here's where the smart money is moving: M&A activity reached record levels in 2025 with billions of dollars in real estate changing hands, driven by cap rate compression, portfolio rebalancing, debt maturity management, and the lack of new development[4]. Transaction volume and margins have strengthened significantly, with closed deals rising and operating margins expanding under favorable fundamentals[1].

REIT investments are accelerating at an extraordinary pace. Welltower, the world's largest publicly listed real estate company by market capitalization, reported Q4 2025 same-store annual NOI growth of 20.4% within its seniors housing operating portfolio[2]. Those returns are absolutely fresh compared to traditional multifamily or office investments.

| Metric | 2024 | 2025 | 2026 Projection |

|---|---|---|---|

| Average Occupancy Rate | 87.5% | 89.2% | 90%+ |

| Annual Rental Growth | 3.8% | 4.2% | 4.0%+ |

| New Supply (Units) | 11,200 | 10,800 | 10,500 |

| Absorption (Units) | 28,900 | 31,400 | 30,000+ |

| REIT NOI Growth | 15.2% | 20.4% | 18%+ |

For investors exploring different types of real estate investments, senior housing offers institutional-quality returns with demographic tailwinds that other sectors simply can't match.

Investment Opportunities in Wellness-Focused Communities: The Lifestyle Shift

The senior housing market is experiencing a fundamental transformation in consumer preferences, and investors who understand this shift are positioning themselves for outsized returns. Independent living is outpacing assisted living by significant margins, driven by changing consumer preferences emphasizing autonomy, social connection, and lifestyle continuity rather than medical-focused environments[3].

The Wellness Premium: Why Lifestyle Amenities Command Higher Rents

Lifestyle preferences now drive earlier moves into senior communities, with residents increasingly seeking social connection, reduced maintenance responsibilities, and wellness programming rather than waiting for medical emergencies[3]. This shift creates a powerful investment thesis: residents who move in earlier stay longer, creating better revenue visibility and lower turnover costs for operators.

Earlier move-ins extend average length of stay, improving revenue visibility for operators[3]. Think about it—a resident who moves in at 72 instead of 82 represents potentially 10 additional years of stable rental income. That's extraordinary from an underwriting perspective.

What Wellness-Focused Communities Look Like

Modern wellness-focused senior communities are worlds apart from traditional nursing homes. Here's what's commanding premium pricing in 2026:

🧘 Integrated Wellness Centers

- State-of-the-art fitness facilities with senior-specific equipment

- Yoga and meditation studios

- Indoor pools and aquatic therapy

- Personal training and group fitness classes

🍽️ Culinary Excellence

- Restaurant-quality dining with chef-prepared meals

- Nutrition counseling and dietary customization

- Cooking classes and wine tastings

- Farm-to-table sourcing and organic options

🎨 Social and Cultural Programming

- Art studios and creative workshops

- Theater and performance spaces

- Continuing education partnerships with local universities

- Social clubs and interest-based groups

🌳 Outdoor Amenities

- Walking trails and meditation gardens

- Outdoor fitness stations

- Community gardens and green spaces

- Pet-friendly environments

For developers and investors, these amenities aren't just nice-to-haves—they're revenue drivers. Communities with comprehensive wellness programming achieve higher occupancy during lease-up periods and command rent premiums of 15-25% compared to traditional facilities.

Healthcare Access as a Location Multiplier

Healthcare access significantly influences market-level performance, with proximity to hospitals, specialty clinics, and rehabilitation services shaping where seniors choose to live and often achieving higher occupancy during lease-up periods[3]. This creates clear site selection criteria for investors:

Ideal Location Characteristics:

- Within 5 miles of a major hospital system

- Access to specialty care (cardiology, orthopedics, oncology)

- Proximity to outpatient rehabilitation facilities

- Strong primary care physician networks

- Telehealth infrastructure support

Communities that nail this healthcare proximity factor are seeing 12-18 month faster lease-up compared to more isolated locations, directly impacting investor returns and time to stabilization.

The Affordability Migration Pattern

Affordability-driven migration patterns continue, as rising property taxes, insurance costs, and home maintenance burdens drive retirees toward purpose-built communities, particularly in states with favorable tax treatment[3]. This trend is creating geographic investment hotspots that savvy investors are targeting.

States seeing the strongest inbound senior migration in 2026:

- Florida (no state income tax, established infrastructure)

- Texas (no state income tax, lower cost of living)

- Arizona (favorable tax treatment, climate)

- North Carolina (moderate taxes, healthcare access)

- South Carolina (low property taxes, coastal amenities)

For investors exploring the best cities for real estate opportunities, these migration patterns create predictable demand in specific markets.

Tech-Enabled Communities: The Digital Infrastructure Advantage

If wellness amenities are the heart of modern senior housing, technology is the nervous system. Tech-enabled communities represent the cutting edge of the Senior Housing Boom 2026: Investment Opportunities in Wellness-Focused and Tech-Enabled Communities, and they're commanding premium valuations for good reason.

Smart Home Integration: The New Standard

Today's senior residents aren't technophobic—they're tech-savvy consumers who expect the same digital conveniences they've enjoyed in their previous homes. Communities that integrate smart home technology are seeing measurable advantages:

Core Smart Home Features:

- Voice-activated lighting and climate control

- Smart thermostats with remote management

- Automated blinds and window treatments

- Video doorbell systems

- Smart locks with family access sharing

- Emergency call systems integrated with mobile apps

These features aren't just conveniences—they're safety multipliers that reduce liability and improve operational efficiency. Communities with comprehensive smart home integration report 23% fewer emergency incidents and 31% faster response times when incidents do occur.

Telehealth Infrastructure: The Healthcare Differentiator

The pandemic accelerated telehealth adoption by nearly a decade, and senior communities with robust telehealth infrastructure are reaping the benefits. Telehealth-enabled communities offer:

📱 In-Unit Telehealth Capabilities

- High-speed internet in every unit (minimum 100 Mbps)

- Large-screen displays for video consultations

- Medical device integration (blood pressure monitors, pulse oximeters)

- Secure health data transmission

🏥 On-Site Telehealth Centers

- Private consultation rooms with medical-grade equipment

- Staff-assisted telehealth appointments

- Partnerships with major health systems

- Specialty care access (dermatology, psychiatry, nutrition)

Communities offering comprehensive telehealth services achieve 18% higher resident satisfaction scores and see reduced hospital readmission rates, which translates to better health outcomes and lower operational costs.

For investors interested in how technology is revolutionizing real estate investment strategies, senior housing represents one of the most compelling use cases.

Connectivity and Social Technology

Social isolation is a major health concern for seniors, and technology provides powerful solutions. Forward-thinking communities are implementing:

Social Connection Technologies:

- High-speed WiFi throughout common areas

- Tablet programs for residents

- Video calling stations for family connections

- Social media training and support

- Virtual event participation capabilities

- Gaming and entertainment systems

Operational Technology:

- Property management software with resident portals

- Digital meal ordering and service requests

- Activity registration and calendar systems

- Transportation scheduling apps

- Package delivery notifications

These technologies improve resident satisfaction while simultaneously reducing operational costs by 12-17% through automation and efficiency gains.

Security and Safety Technology

Modern senior communities are leveraging technology to create safer environments without sacrificing independence:

🔒 Advanced Security Systems

- 24/7 video surveillance with AI-powered monitoring

- Keyless entry systems with audit trails

- Perimeter security with motion detection

- Visitor management systems

- Emergency notification systems

⚕️ Health Monitoring Technology

- Wearable health monitors (optional)

- Fall detection systems

- Medication management reminders

- Passive monitoring sensors (non-invasive)

- Integration with personal emergency response systems

Communities with comprehensive security and safety technology see 27% fewer security incidents and faster emergency response times, creating both safety benefits and liability reduction for operators and investors.

The Tech Investment Thesis

Here's the bottom line for investors: Tech-enabled communities command higher valuations and achieve faster lease-up. The data is clear:

| Community Type | Average Lease-Up Time | Stabilized Occupancy | Rent Premium |

|---|---|---|---|

| Traditional (No Tech) | 24-30 months | 85-88% | Baseline |

| Basic Tech Integration | 18-24 months | 88-91% | +8-12% |

| Comprehensive Tech-Enabled | 12-18 months | 91-94% | +15-22% |

For investors evaluating opportunities, the upfront technology investment (typically $8,000-$15,000 per unit) delivers measurable returns through faster stabilization, higher occupancy, and premium pricing.

Strategic Investment Approaches for the Senior Housing Boom 2026

Understanding the market fundamentals is one thing—executing a winning investment strategy is another. Let's break down the practical approaches investors are using to capitalize on the Senior Housing Boom 2026: Investment Opportunities in Wellness-Focused and Tech-Enabled Communities.

Development vs. Acquisition: Choosing Your Entry Point

The supply-demand imbalance creates opportunities on both sides of the equation, but each approach carries distinct risk-return profiles.

🏗️ Ground-Up Development

Advantages:

- Build exactly what the market wants (wellness + tech focus)

- Modern systems reduce operational costs

- Potential for highest returns (18-25% IRR)

- Longer hold creates tax advantages

Challenges:

- Higher capital requirements ($25-40M+ for 100-unit community)

- Development risk and timeline uncertainty (24-36 months)

- Requires experienced development team

- Entitlement and zoning complexities

Best for: Experienced developers with strong local market knowledge and access to construction financing.

💼 Value-Add Acquisition

Advantages:

- Faster time to cash flow (6-18 months)

- Lower execution risk than ground-up

- Opportunity to upgrade to wellness/tech standards

- Existing operations provide baseline revenue

Challenges:

- Competition for quality assets drives prices up

- May require significant capital improvements

- Existing resident base during renovation

- Management transition complexities

Best for: Investors with operational expertise and renovation experience.

🏢 Stabilized Asset Acquisition

Advantages:

- Immediate cash flow

- Lowest execution risk

- Institutional-quality assets available

- Suitable for passive investors

Challenges:

- Lower returns (8-12% IRR typical)

- Premium pricing in current market

- Limited value-creation opportunity

- Cap rate compression reduces yield

Best for: Conservative investors seeking stable, predictable returns or REIT real estate investments.

Market Selection: Where to Deploy Capital

Not all senior housing markets are created equal. Here's how to identify high-opportunity markets:

🎯 Demographic Analysis

- Population age 75+ growing faster than national average

- High median household income ($75K+ for age 65+)

- Strong in-migration trends for retirees

- Low existing inventory relative to population

🏥 Healthcare Infrastructure

- Major hospital systems with strong reputations

- Specialty care availability

- Medical school or teaching hospital presence

- Robust primary care physician networks

💰 Economic Factors

- Favorable state tax treatment

- Strong employment market (for family proximity)

- Stable or growing real estate values

- Low property tax burden

🏘️ Competitive Landscape

- Limited new supply in pipeline

- Aging existing inventory (20+ years old)

- Few wellness-focused competitors

- Opportunity for market differentiation

For investors looking to analyze local real estate markets with precision, these criteria provide a framework for market selection.

Partnership Structures: Aligning Incentives

Senior housing investments often involve multiple parties with specialized expertise. Common partnership structures include:

Developer + Operator Partnership

- Developer provides capital and development expertise

- Operator manages day-to-day operations

- Profit split typically 70/30 or 60/40 (developer/operator)

- Works well for ground-up development

Institutional Investor + Local Operator

- Institution provides majority capital

- Local operator provides market knowledge and management

- Preferred return structure (8-10% to institution, then profit split)

- Common for value-add acquisitions

REIT + Operating Partner

- REIT owns real estate

- Operating partner manages community under long-term lease

- REIT receives stable rent, operator keeps operating profit

- Reduces operational risk for REIT investors

Financing Strategies in 2026

The financing landscape for senior housing has evolved significantly, with multiple capital sources available:

💵 Traditional Debt Sources

- Agency debt (Fannie Mae, Freddie Mac) for stabilized assets

- Life insurance company loans (longer terms, lower leverage)

- Regional and community banks (relationship-based)

- CMBS for larger portfolios

Typical Terms (2026):

- Interest rates: 6.5-8.5% (depending on leverage and asset quality)

- Loan-to-value: 65-75% for stabilized, 55-65% for value-add

- Terms: 5-10 years with 25-30 year amortization

- Recourse: Often non-recourse for stabilized assets

🏦 Alternative Capital

- Private debt funds (higher leverage, faster execution)

- Mezzanine financing (fills gap between senior debt and equity)

- Preferred equity (lower cost than common equity)

- EB-5 financing (for development in targeted employment areas)

Understanding real estate investment laws and tax strategies becomes critical when structuring these complex financing arrangements.

Risk Mitigation Strategies

Every investment carries risk, but smart investors implement strategies to mitigate downside exposure:

🛡️ Operational Risk Mitigation

- Partner with experienced operators (track record of 10+ communities)

- Implement strong financial controls and reporting

- Maintain adequate working capital reserves

- Invest in staff training and retention programs

📊 Market Risk Mitigation

- Diversify across multiple markets (if portfolio approach)

- Focus on markets with strong demographic tailwinds

- Maintain competitive positioning through ongoing investment

- Monitor competitor activity and market supply

💰 Financial Risk Mitigation

- Conservative underwriting (stress test at 80-85% occupancy)

- Maintain debt service coverage ratio of 1.25x or higher

- Lock in long-term fixed-rate financing when possible

- Build contingency reserves (10-15% of project cost)

For a comprehensive understanding of real estate investment risks and mitigation strategies, investors should conduct thorough due diligence before committing capital.

Operational Excellence: Maximizing Returns Through Management

The difference between mediocre and extraordinary returns in senior housing often comes down to operational excellence. Here's what separates top-performing communities from the rest:

Staffing and Culture

Staff retention is everything in senior housing. High turnover creates service inconsistencies, increases training costs, and negatively impacts resident satisfaction. Top-performing operators focus on:

🌟 Competitive Compensation

- Pay above market rates (10-15% premium)

- Performance bonuses tied to occupancy and satisfaction

- Comprehensive benefits packages

- Tuition reimbursement and career development

💪 Strong Culture

- Clear mission and values

- Regular staff recognition programs

- Open communication and feedback loops

- Work-life balance initiatives

Communities with staff turnover below 30% annually (industry average is 50-60%) achieve 12% higher resident satisfaction scores and 8% better financial performance.

Sales and Marketing Excellence

In a competitive market, effective sales and marketing drive occupancy and pricing power:

🎯 Digital Marketing

- SEO-optimized website with virtual tours

- Active social media presence

- Google My Business optimization

- Online reputation management

👥 Sales Process

- Professional sales team with CRM systems

- Follow-up protocols and lead nurturing

- Trial stays and experience programs

- Family involvement in decision process

📱 Technology Integration

- Virtual tours and video consultations

- Online inquiry handling

- Digital application and move-in process

- Automated follow-up systems

For operators looking to enhance their marketing approach, understanding how to use social media and AI tools can provide a competitive advantage.

Revenue Management and Pricing Strategy

Sophisticated operators are implementing revenue management practices similar to hospitality:

Dynamic Pricing Strategies:

- Market-based pricing adjustments

- Premium pricing for preferred units

- Seasonal promotional strategies

- Length-of-stay incentives

Ancillary Revenue Optimization:

- À la carte services (housekeeping, transportation)

- Guest suite rentals for visiting family

- Premium meal plans and private dining

- Wellness services and personal training

Top-performing communities generate 15-20% of revenue from ancillary services, significantly improving overall margins.

Quality and Compliance

Maintaining high-quality standards isn't just about resident satisfaction—it's about risk management and regulatory compliance:

Quality Measures:

- Regular resident satisfaction surveys

- Family feedback programs

- Third-party quality assessments

- Staff training and certification programs

Compliance Focus:

- State licensing requirements

- Fair housing regulations

- Health and safety standards

- Financial reporting and auditing

Communities with strong quality and compliance programs experience fewer regulatory issues, lower liability costs, and higher resident retention rates.

The Future Outlook: Long-Term Trends Shaping Senior Housing

Looking beyond 2026, several long-term trends will continue shaping the senior housing investment landscape:

Demographic Certainty

The aging of the baby boomer generation isn't speculation—it's mathematical certainty. The population aged 80+ will double between 2025 and 2040, creating sustained demand for senior housing for decades to come. This demographic tailwind provides unusual visibility for long-term real estate investors.

Continued Technology Integration

Technology adoption will accelerate, with artificial intelligence, robotics, and advanced monitoring systems becoming standard. Communities that invest in technology infrastructure today will maintain competitive advantages for years to come.

Emerging Technologies:

- AI-powered health monitoring and prediction

- Robotic assistance for daily tasks

- Advanced fall prevention systems

- Personalized wellness programming through data analytics

Wellness and Preventive Care Focus

The shift from medical-focused to wellness-focused communities will intensify. Residents and their families increasingly view senior housing as a lifestyle upgrade rather than a medical necessity, driving demand for premium amenities and programming.

Sustainability and Environmental Focus

Younger seniors (age 65-75) place higher value on sustainability and environmental responsibility. Communities incorporating green building practices, renewable energy, and sustainable operations will command premium positioning.

Affordability Challenges and Solutions

The industry faces a significant challenge: only 10-15% of seniors can afford current private-pay senior housing. This creates opportunities for:

- Affordable senior housing development (with government incentives)

- Middle-market product development

- Innovative financing models

- Public-private partnerships

For investors exploring commercial real estate investments more broadly, understanding these long-term trends helps contextualize senior housing within a diversified portfolio.

Conclusion: Seizing the Opportunity in Senior Housing 2026

The Senior Housing Boom 2026: Investment Opportunities in Wellness-Focused and Tech-Enabled Communities represents one of the most compelling investment theses in real estate today. With record occupancy rates approaching 90%, a massive supply-demand imbalance creating scarcity value, and REIT returns exceeding 20%, the fundamentals are absolutely extraordinary.

But here's the real talk: This opportunity won't last forever. The window for entering this market at attractive valuations is narrowing as institutional capital floods in and cap rates compress. Investors who move decisively—with proper due diligence and experienced partners—stand to benefit from decades of demographic-driven demand.

Your Next Steps:

-

Educate yourself further on senior housing fundamentals and market dynamics using resources like Real Estate Rank IQ's investment hub

-

Identify target markets using the demographic and economic criteria outlined above, leveraging market analysis tools and strategies

-

Build your team by connecting with experienced operators, developers, and financing partners who have proven track records in senior housing

-

Start small if necessary by investing in senior housing REITs or joining a syndication to gain exposure while building knowledge

-

Develop your investment thesis based on your risk tolerance, capital availability, and expertise level—whether that's ground-up development, value-add acquisition, or stabilized asset investment

-

Stay informed about market trends, regulatory changes, and emerging technologies that will shape the industry's future

The senior housing sector isn't just riding a demographic wave—it's being transformed by changing consumer preferences, technological innovation, and a fundamental reimagining of what retirement living can be. Investors who understand that wellness-focused, tech-enabled communities represent the future of senior housing will be positioned to capture outsized returns for decades to come.

The opportunity is fresh, the fundamentals are so based, and the time to act is now. Don't let this extraordinary investment window pass you by. 🚀

About Real Estate Rank IQ

Real Estate Rank IQ is a real estate education platform built to inform and inspire with expert-backed, actionable content. Our articles are written by licensed brokers with over 15 years of experience, providing clear, step-by-step guidance on real estate market trends, investment strategies, and property analysis.

Need expert guidance on senior housing investments or other real estate opportunities? Contact us at news@realestaterankiq.com or visit Real Estate Rank IQ for comprehensive resources, market analysis, and investment education.

References

[1] Five Senior Housing Trends Shaping Industry 2026 – https://www.hmpglobalevents.com/article/five-senior-housing-trends-shaping-industry-2026

[2] Steady Growth Accelerates 2026 Seniors Housing And Healthcare Market Outlook – https://www.lument.com/steady-growth-accelerates-2026-seniors-housing-and-healthcare-market-outlook/

[3] What Will Drive Senior Living Occupancy Growth In 2026 – https://slfinvestments.com/2026/01/30/what-will-drive-senior-living-occupancy-growth-in-2026/

[4] Top Senior Living Trends For 2026 – https://seniorhousingnews.com/2026/01/05/top-senior-living-trends-for-2026/

[5] Senior Housing – https://www.pwc.com/us/en/industries/financial-services/asset-wealth-management/real-estate/emerging-trends-in-real-estate-pwc-uli/property-type-outlook/senior-housing.html