Picture this: You're standing at the crossroads of a major investment decision, armed with nothing but gut instinct and a prayer. That's so not based in 2026. The extraordinary evolution of artificial intelligence has transformed real estate investment analysis from educated guesswork into data-driven precision. But here's where it gets interesting—not all AI platforms are created equal, and choosing between HouseCanary and Skyline AI could be the difference between impeccable returns and costly missteps.

The quest for the best real estate investment analysis has never been more critical. With market volatility, rising interest rates, and shifting demographic patterns reshaping the landscape, investors need tools that don't just crunch numbers—they need platforms that predict the future. Whether you're a seasoned broker managing multiple portfolios or a first-time investor dipping your toes into property markets, understanding which AI platform aligns with your strategy is absolutely essential.

Key Takeaways 🎯

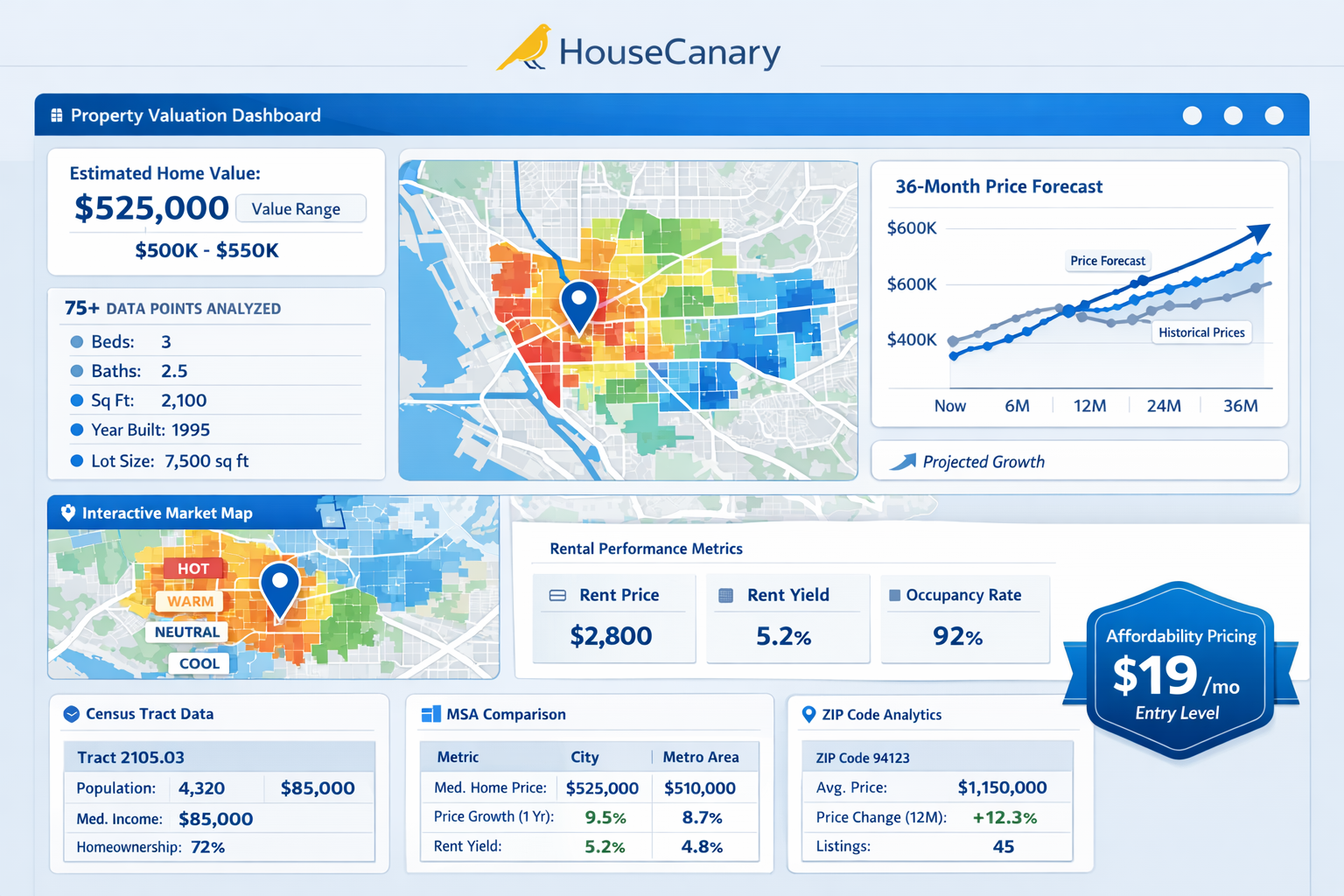

- HouseCanary specializes in residential property analysis with 75+ data points, 36-month forecasting, and accessible pricing starting at $19/month—perfect for individual investors and residential-focused professionals[2]

- Skyline AI targets commercial real estate investors with enterprise-level machine learning models, institutional-grade analytics, and premium pricing designed for portfolio-scale operations[1][3]

- The best real estate investment analysis platform depends entirely on your investment focus: residential versus commercial, individual properties versus large portfolios, and budget constraints

- Both platforms leverage cutting-edge AI technology but serve fundamentally different market segments and investor profiles

- Integration capabilities, data comprehensiveness, and forecasting accuracy vary significantly between platforms, impacting long-term investment success

Understanding the AI Revolution in Real Estate Investment Analysis 🤖

The real estate industry has undergone a dope transformation over the past decade. Gone are the days when investors relied solely on comparable sales, broker opinions, and local market knowledge. Today's real estate investment technology landscape is dominated by artificial intelligence platforms that process millions of data points in seconds, identifying patterns invisible to the human eye.

The global AI in real estate market is projected to grow from $1.4 billion in 2024 to $13.8 billion by 2033, representing a compound annual growth rate that's nothing short of extraordinary[8]. This explosive growth reflects a fundamental shift in how professionals approach property valuation, risk assessment, and investment decision-making.

But here's what nobody's gatekeeping anymore: AI platforms aren't just fancy calculators. They're sophisticated prediction engines that analyze historical trends, current market conditions, demographic shifts, economic indicators, and even social sentiment to forecast property performance with unprecedented accuracy. The question isn't whether to use AI for investment analysis—it's which platform delivers the insights you actually need.

Why Traditional Analysis Methods Fall Short

Traditional real estate analysis methods typically involve:

- Manual comparable sales research (time-intensive and backward-looking)

- Broker price opinions (subjective and potentially biased)

- Spreadsheet modeling (limited variables and static assumptions)

- Local market knowledge (valuable but not scalable)

While these methods still have their place, they simply can't compete with AI platforms that simultaneously analyze economic indicators, demographic trends, infrastructure development, employment patterns, crime statistics, school ratings, environmental factors, and thousands of other variables to generate comprehensive investment insights[2][5].

HouseCanary: The Residential Real Estate Investment Powerhouse 🏡

HouseCanary has earned its reputation as "one of the most accurate property valuation solutions available" and stands as an industry leader for AI-driven property valuation models[1][2]. What makes this platform particularly fresh is its focus on accessibility without sacrificing analytical depth.

Core Features and Capabilities

Comprehensive Data Coverage: HouseCanary provides access to over 75 data points covering individual properties, census tracts, ZIP codes, Metropolitan Statistical Areas (MSAs), and state-level analytics[2]. This isn't just surface-level information—we're talking deep dives into:

- Property characteristics and condition assessments

- Historical sales and listing data

- Rental market performance metrics

- Neighborhood demographic profiles

- School district ratings and proximity

- Crime statistics and safety indexes

- Infrastructure and amenity access

- Environmental risk factors

Predictive Forecasting: The platform's proprietary models project home price and rental performance up to 36 months forward[2]. This forward-looking capability transforms investment analysis from reactive to proactive, allowing investors to identify emerging opportunities before they become obvious to the broader market.

Market Intelligence: HouseCanary includes sophisticated rental value insights and market volatility metrics designed for long-term planning[2]. For investors focused on rental analysis and portfolio growth, these features provide critical context for cash flow projections and risk assessment.

Pricing and Accessibility

Here's where HouseCanary really shines: pricing starts at just $19/month for basic plans[1][2]. This makes it one of the most affordable entry points for professional-grade property valuation tools. The tiered pricing structure means individual investors, agents, and small teams can access institutional-quality analytics without enterprise-level budgets.

This accessibility democratizes the best real estate investment analysis tools, leveling the playing field between individual investors and large institutions. No more gatekeeping of advanced analytics behind six-figure subscription fees.

Primary Use Cases

HouseCanary excels in several specific applications:

- Single-Property Analysis: Deep-dive valuations for individual residential properties

- Portfolio Evaluation: Comparative analysis across multiple residential holdings

- Underwriting Support: Data-driven due diligence for acquisition decisions

- Risk Assessment: Volatility metrics and downside scenario modeling

- Lending Decisions: Valuation workflows for mortgage origination and refinancing[2][5]

Who Should Choose HouseCanary?

This platform is impeccable for:

- Residential real estate investors building single-family or small multifamily portfolios

- Real estate agents and brokers serving buyer and seller clients

- Fix-and-flip investors evaluating acquisition and after-repair values

- Rental property investors analyzing cash flow potential

- Lenders and mortgage professionals requiring accurate valuation data

- Individual investors with limited budgets seeking professional-grade analytics

The platform's residential focus means it's particularly strong for those implementing property investment strategies centered on housing markets rather than commercial properties.

Skyline AI: Enterprise-Grade Commercial Real Estate Intelligence 🏢

While HouseCanary dominates the residential space, Skyline AI has carved out its niche as the go-to platform for commercial real estate investors seeking institutional-grade analytics[1]. This isn't a tool for casual investors—it's a sophisticated machine learning system designed for serious commercial property analysis.

Commercial Real Estate Specialization

Skyline AI's machine learning models are tailored specifically for commercial properties rather than residential[1]. This specialization matters enormously because commercial real estate operates under fundamentally different dynamics than residential:

- Lease structures (long-term commercial leases versus shorter residential tenancies)

- Tenant creditworthiness (corporate versus individual credit profiles)

- Property valuation methods (income capitalization versus comparable sales)

- Market drivers (employment and business growth versus demographic trends)

- Investment structures (institutional partnerships versus individual ownership)

By focusing exclusively on commercial properties, Skyline AI delivers insights that generic platforms simply can't match.

Integration Strategy and Ecosystem

One of Skyline AI's most extraordinary features is its integration with complementary tools like Reonomy and AirDNA[1]. This ecosystem approach creates a comprehensive analytical framework:

- Reonomy provides detailed property ownership data, transaction history, and building characteristics for commercial properties

- AirDNA delivers short-term rental market intelligence for commercial properties exploring alternative use strategies

- Skyline AI synthesizes these data sources with its proprietary machine learning models to generate actionable investment insights

This integration capability transforms Skyline AI from a standalone tool into a central intelligence hub for commercial real estate investments.

Portfolio-Scale Analysis

Skyline AI is designed for institutional and commercial portfolio investors requiring enterprise-level analysis[3]. The platform excels at:

- Multi-property portfolio optimization: Identifying which assets to acquire, hold, or dispose

- Market trend prediction: Forecasting commercial property values across different segments

- Risk-adjusted return modeling: Comparing opportunities across diverse commercial property types

- Geographic diversification analysis: Evaluating markets for expansion or consolidation

- Scenario planning: Stress-testing portfolios against various economic conditions

For investors managing or considering real estate investment strategies across global markets, Skyline AI's institutional-grade capabilities provide the analytical horsepower needed for complex decision-making.

Pricing and Investment Level

Skyline AI operates on an enterprise-tier pricing model[3]. While specific cost details aren't publicly disclosed, this positioning clearly indicates the platform targets larger operations with substantial capital deployment. The premium pricing reflects:

- Sophisticated machine learning algorithms

- Commercial property specialization

- Integration with premium data sources

- Enterprise-level support and customization

- Institutional-grade security and compliance

Who Should Choose Skyline AI?

This platform makes sense for:

- Commercial real estate investors focused on office, retail, industrial, or multifamily properties

- Institutional investors managing large portfolios

- Real estate investment trusts (REITs) requiring sophisticated analytics

- Commercial brokers serving institutional clients

- Private equity firms evaluating commercial property acquisitions

- Developers analyzing commercial development opportunities

For professionals working with REIT real estate investments or managing substantial commercial portfolios, Skyline AI's specialized capabilities justify the premium investment.

Head-to-Head Comparison: Finding the Best Real Estate Investment Analysis Platform 📊

Let's break down the critical differences between these platforms across key decision factors:

Investment Focus

| Factor | HouseCanary | Skyline AI |

|---|---|---|

| Primary Market | Residential properties | Commercial properties |

| Property Types | Single-family, small multifamily, condos | Office, retail, industrial, large multifamily |

| Investor Profile | Individual to small institutional | Institutional and enterprise |

| Portfolio Size | 1-100+ properties | 10-1000+ properties |

Analytical Capabilities

| Feature | HouseCanary | Skyline AI |

|---|---|---|

| Data Points | 75+ comprehensive metrics[2] | Specialized commercial metrics |

| Forecasting Period | Up to 36 months[2] | Market trend predictions |

| Valuation Focus | Residential comparable sales, rental analysis | Commercial income capitalization |

| AI Technology | Proprietary valuation models[1][2] | Machine learning for commercial properties[1] |

| Market Intelligence | Rental values, volatility metrics[2] | Commercial market trends[1] |

Accessibility and Pricing

| Aspect | HouseCanary | Skyline AI |

|---|---|---|

| Starting Price | $19/month[1][2] | Enterprise pricing (undisclosed)[3] |

| Target Budget | Individual to small business | Institutional investment level |

| Entry Barrier | Low—accessible to most investors | High—requires significant capital deployment |

| ROI Timeline | Immediate for small investments | Long-term for portfolio optimization |

Integration and Workflow

HouseCanary focuses on standalone residential analysis with API access for integration into existing workflows[2]. It's designed for quick property evaluations and supports:

- Individual property underwriting

- Comparative market analysis

- Rental rate optimization

- Portfolio monitoring

- Lending decision support[2][5]

Skyline AI emphasizes ecosystem integration with complementary commercial tools[1]. It's built for complex analytical workflows involving:

- Multi-source data synthesis

- Portfolio-level optimization

- Commercial market forecasting

- Institutional investment committee presentations

- Strategic planning and scenario analysis[1][3]

Accuracy and Reliability

HouseCanary is recognized as "one of the most accurate property valuation solutions available" and is particularly popular among institutional lenders[1][2][5]. This reputation stems from:

- Extensive historical validation

- Continuous model refinement

- Comprehensive data coverage

- Transparent methodology

Skyline AI's accuracy derives from its commercial property specialization and machine learning approach[1]. By focusing exclusively on commercial real estate, the platform avoids the dilution that comes from trying to serve all property types.

Making Your Decision: Which Platform Delivers the Best Real Estate Investment Analysis? 🎯

The truth is, there's no universal "best" platform—only the best platform for your specific investment strategy. Here's how to make an informed decision:

Choose HouseCanary If You:

✅ Invest primarily in residential properties (single-family homes, small multifamily, condos)

✅ Need affordable access to professional-grade analytics ($19/month entry point)[1][2]

✅ Focus on individual property analysis rather than large portfolio management

✅ Require rental market intelligence for cash flow projections[2]

✅ Value 36-month price forecasting for timing acquisition and disposition decisions[2]

✅ Work as an agent or broker serving residential clients

✅ Operate with limited technology budgets but still want institutional-quality data

✅ Need quick property valuations for fast-moving residential markets

For investors exploring real estate market trends and identifying lucrative investment opportunities in residential markets, HouseCanary provides the analytical foundation for confident decision-making.

Choose Skyline AI If You:

✅ Focus exclusively on commercial real estate (office, retail, industrial, large multifamily)

✅ Manage institutional-scale portfolios requiring sophisticated analytics[3]

✅ Have enterprise-level budgets for technology investments

✅ Need integration with commercial data sources like Reonomy and AirDNA[1]

✅ Require portfolio optimization across multiple properties and markets

✅ Make investment decisions at scale involving significant capital deployment

✅ Value specialized commercial market forecasting over general property analytics[1]

✅ Operate as a REIT, private equity firm, or institutional investor[3]

For professionals navigating real estate investment risks in commercial markets, Skyline AI's specialized capabilities provide the depth needed for complex investment decisions.

The Hybrid Approach

Some sophisticated investors actually use both platforms to cover different aspects of their investment strategy:

- HouseCanary for residential property analysis and smaller investments

- Skyline AI for commercial portfolio management and institutional holdings

This approach maximizes analytical coverage across diverse property types while leveraging each platform's specific strengths. However, it requires budget allocation for both subscriptions and the operational capacity to integrate insights from multiple systems.

Maximizing Your Investment Analysis Platform 💡

Regardless of which platform you choose, getting the best real estate investment analysis requires more than just subscribing to software. Here are strategies to maximize your investment:

Data Quality and Input

Garbage in, garbage out remains true even with AI. Ensure you're:

- Providing accurate property information

- Updating data regularly as market conditions change

- Cross-referencing AI outputs with local market knowledge

- Understanding the limitations of algorithmic predictions

Complementary Analysis

AI platforms should enhance, not replace, fundamental investment analysis. Combine platform insights with:

- Physical property inspections

- Local market expertise from experienced real estate professionals

- Financial modeling and sensitivity analysis

- Legal and regulatory due diligence

- Environmental and structural assessments

Continuous Learning

Both platforms regularly update their algorithms and add new features. Stay current by:

- Participating in platform training and webinars

- Reading release notes and feature announcements

- Joining user communities and forums

- Experimenting with new analytical capabilities

- Providing feedback to platform developers

Integration with Broader Strategy

The best real estate investment analysis happens when AI insights integrate seamlessly with your overall investment strategy. Consider how platform outputs inform:

- Acquisition criteria and screening processes

- Pricing and negotiation strategies

- Portfolio allocation and diversification

- Risk management and hedging approaches

- Exit timing and disposition planning

Understanding AI Limitations

Even the most sophisticated AI platforms have limitations:

- Historical bias: Models trained on past data may not predict unprecedented market shifts

- Black swan events: Algorithms struggle with rare, high-impact events (pandemics, financial crises)

- Local nuances: AI may miss hyperlocal factors known to area specialists

- Data gaps: Analysis quality depends on underlying data availability and accuracy

- Interpretation requirements: AI provides insights, but humans make final decisions

Recognizing these limitations helps you use platforms appropriately while maintaining healthy skepticism about algorithmic certainty.

The Future of AI-Driven Real Estate Investment Analysis 🔮

The AI revolution in real estate is just getting started. Looking ahead to the rest of 2026 and beyond, several trends will shape the evolution of platforms like HouseCanary and Skyline AI:

Enhanced Predictive Capabilities

Machine learning models will continue improving as they ingest more data and refine their algorithms. Expect forecasting accuracy to increase, prediction windows to extend beyond 36 months, and scenario modeling to become more sophisticated[8].

Broader Data Integration

Future platforms will likely incorporate:

- Climate risk data (flooding, wildfire, extreme weather impacts)

- Social sentiment analysis (neighborhood desirability trends from social media)

- Infrastructure development (transportation projects, utility upgrades)

- Regulatory changes (zoning modifications, tax policy shifts)

- Economic indicators (employment trends, wage growth, migration patterns)

This expanded data integration will provide even more comprehensive investment intelligence.

Democratization of Advanced Analytics

Following HouseCanary's lead, expect more platforms to offer affordable entry points that bring institutional-grade analytics to individual investors. The gatekeeping of advanced real estate intelligence is ending, creating opportunities for smaller players to compete effectively.

Specialized Niche Platforms

While HouseCanary focuses on residential and Skyline AI on commercial, we'll likely see platforms emerge targeting specific niches:

- Short-term rental optimization

- Development site analysis

- Distressed property identification

- ESG and sustainability metrics

- Demographic-specific housing (senior living, student housing)

Regulatory Considerations

As AI becomes more prevalent in real estate, expect increased regulatory attention around:

- Algorithmic bias and fair housing compliance

- Data privacy and security requirements

- Disclosure obligations for AI-driven valuations

- Professional liability for algorithm-based decisions

Staying informed about real estate investment laws as they evolve to address AI will be crucial for compliant platform usage.

Real-World Application: Case Study Scenarios 📈

Let's examine how different investor profiles might leverage these platforms:

Scenario 1: First-Time Residential Investor

Profile: Individual investor with $100,000 to deploy in a single-family rental property

Platform Choice: HouseCanary

Application: Use the platform's 75+ data points to screen potential markets, identify neighborhoods with strong rental demand and price appreciation potential, forecast 36-month property values and rental income, and validate asking prices against AI-driven valuations[2]. The $19/month investment provides professional-grade analytics on an individual investor budget[1][2].

Scenario 2: Commercial Portfolio Manager

Profile: REIT managing 50+ commercial properties across multiple markets

Platform Choice: Skyline AI

Application: Leverage machine learning models to optimize portfolio composition, identify underperforming assets for disposition, screen acquisition opportunities across markets, forecast commercial property values at scale, and integrate Reonomy data for ownership intelligence[1][3]. Enterprise pricing is justified by portfolio value and decision impact.

Scenario 3: Residential Real Estate Broker

Profile: Agent working with both buyers and sellers in residential markets

Platform Choice: HouseCanary

Application: Provide clients with data-driven pricing recommendations, identify off-market opportunities through market analysis, demonstrate property value trajectories using 36-month forecasts, and support negotiations with objective valuation data[2][5]. Professional credibility increases with institutional-quality analytics backing recommendations.

Scenario 4: Commercial Real Estate Syndicator

Profile: Operator raising capital for commercial multifamily acquisitions

Platform Choice: Skyline AI

Application: Conduct sophisticated due diligence on target properties, create data-backed investor presentations, benchmark opportunities against market alternatives, and model risk-adjusted returns using commercial-specific analytics[1][3]. Enterprise capabilities support institutional investor expectations.

Conclusion: Your Path to the Best Real Estate Investment Analysis 🚀

The journey to investment success in 2026's complex real estate markets demands more than intuition—it requires impeccable data, extraordinary analytical capabilities, and platforms that transform information into actionable intelligence. Both HouseCanary and Skyline AI represent the cutting edge of AI-driven property analysis, but they serve fundamentally different investment strategies and investor profiles.

HouseCanary dominates the residential space with accessible pricing, comprehensive data coverage, and proven accuracy that's made it an industry leader among lenders and investors alike[1][2][5]. For individual investors, agents, brokers, and residential-focused professionals, it delivers the best real estate investment analysis at a price point that democratizes institutional-quality insights.

Skyline AI owns the commercial real estate intelligence space with specialized machine learning models, enterprise-grade capabilities, and integration ecosystems designed for portfolio-scale operations[1][3]. For institutional investors, REITs, and commercial specialists, it provides the sophisticated analytics needed to make confident decisions involving significant capital deployment.

The best real estate investment analysis platform for you depends entirely on your investment focus, portfolio size, budget constraints, and analytical requirements. There's no one-size-fits-all solution—only the right tool for your specific strategy.

Your Next Steps

Ready to elevate your investment analysis? Here's what to do:

-

Assess your investment focus: Residential or commercial? Individual properties or portfolios?

-

Evaluate your budget: Can you justify enterprise pricing, or do you need affordable access?

-

Trial the platforms: Both HouseCanary and Skyline AI offer demonstrations—experience them firsthand

-

Integrate with existing workflows: Consider how each platform fits your current processes

-

Start small, scale smart: Begin with a focused application, then expand as you prove ROI

-

Combine AI with expertise: Use platforms to enhance, not replace, fundamental analysis

-

Stay educated: Follow real estate investment technology trends to remain competitive

The extraordinary transformation of real estate investment analysis through AI is no longer future speculation—it's present reality. The question isn't whether to embrace these tools, but which platform aligns with your path to investment success. Choose wisely, analyze thoroughly, and invest confidently. Your portfolio will thank you.

For more insights on maximizing your real estate investment strategy, explore our comprehensive guides on property investment strategies and real estate investment financing. The future of real estate investing is data-driven, AI-powered, and absolutely dope—and you're now equipped to leverage it.

References

[1] Ai Tools For Real Estate – https://usleadlist.com/resources/ai-tools-for-real-estate

[2] Real Estate Api – https://www.housecanary.com/blog/real-estate-api

[3] Ai Tools Property Investors Australia 2026 Guide – https://propertyinvestmentprofessionals.com.au/blog/ai-tools-property-investors-australia-2026-guide

[4] Housecanary Vs Skyline Ai – https://sourceforge.net/software/compare/HouseCanary-vs-Skyline-AI/

[5] Best Property Evaluation Apis 2026 – https://homesage.ai/best-property-evaluation-apis-2026/

[6] Abnewswire 2026 1 20 Top 5 Ai Driven Real Estate Platforms Disrupting The 13t Housing Market In 2026 – https://markets.financialcontent.com/theeveningleader/article/abnewswire-2026-1-20-top-5-ai-driven-real-estate-platforms-disrupting-the-13t-housing-market-in-2026

[7] F Startup – https://slashdot.org/software/ai-real-estate/f-startup/?page=2

[8] Ai In Real Estate Global Market Report – https://www.thebusinessresearchcompany.com/report/ai-in-real-estate-global-market-report