Picture this: you're sitting across from your mortgage lender, and they slide two loan options across the table. One promises lower monthly payments that won't stress your budget. The other? A faster path to owning your home outright with extraordinary savings on interest. The choice between a 15-year and 30-year mortgage isn't just about numbers—it's about your financial future, lifestyle goals, and how quickly you want to build wealth through homeownership.

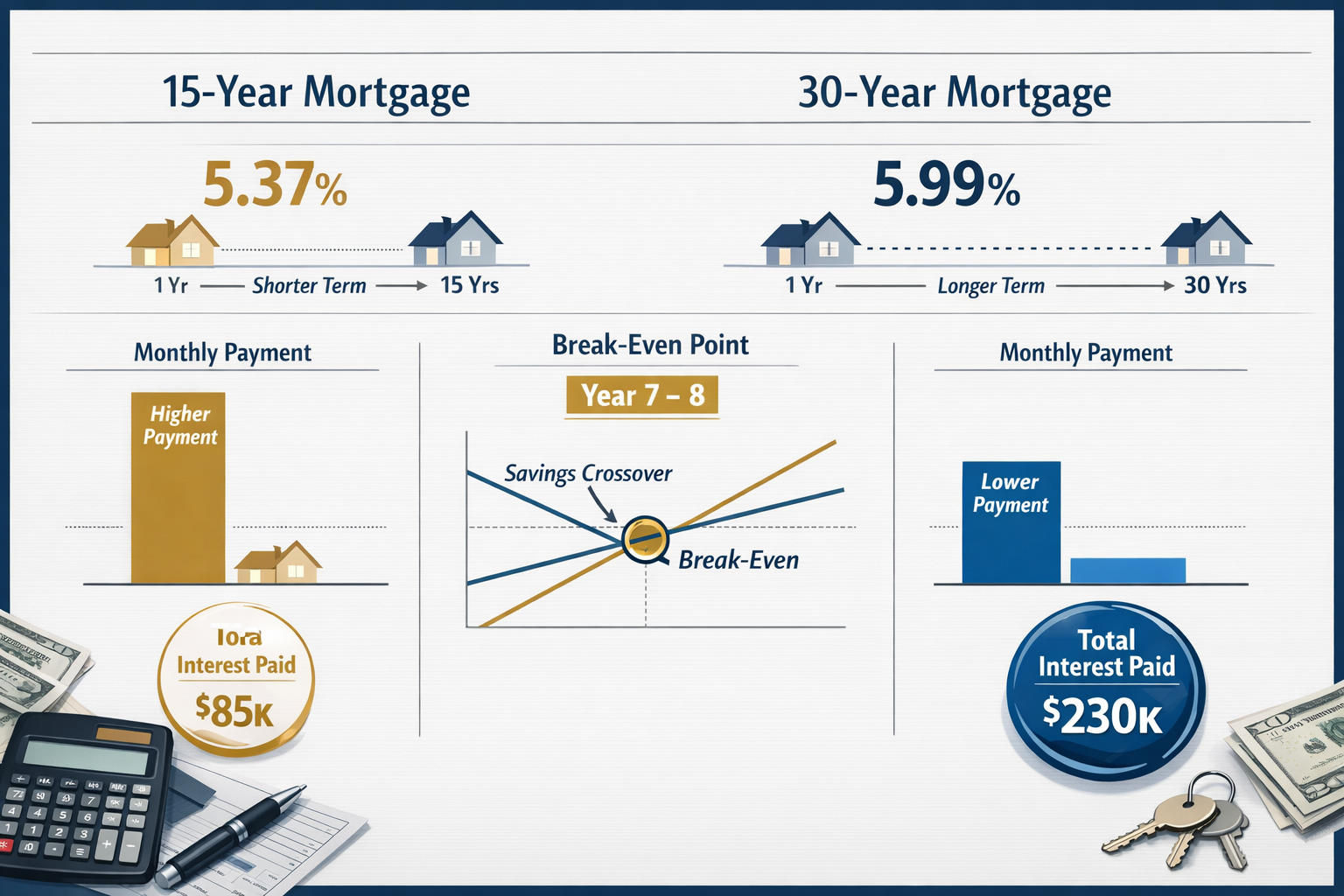

As we navigate the 15-Year vs 30-Year Mortgage Rates in 2026: Which is Best for Long-Term Savings?, the stakes have never been clearer. With 15-year mortgages averaging 5.37% and 30-year loans at 5.99% as of February 2026[3], the rate gap presents a fresh opportunity for savvy homebuyers to make strategic decisions. Whether you're a first-time buyer, seasoned investor, or someone looking to refinance, understanding these mortgage options could save you tens of thousands—or even hundreds of thousands—of dollars over the life of your loan.

Key Takeaways

- Rate advantage is real: 15-year mortgages carry rates approximately 0.62 percentage points lower than 30-year mortgages in 2026, currently averaging 5.37% versus 5.99%[3]

- Monthly payment trade-off: While 15-year mortgages demand higher monthly payments (roughly $238-300 more per month), they can save homeowners $30,000-$50,000+ in total interest costs[1]

- Break-even analysis matters: Most homeowners reach their financial break-even point between years 7-8, making the 15-year option impeccable for those planning to stay long-term

- Market timing is favorable: Current rates are near 3-year lows, approximately one percentage point lower than February 2025[2][3]

- Refinancing opportunities ahead: With Fannie Mae predicting rates will settle around 6% through 2026-2027, strategic refinancing could optimize your mortgage choice[2]

Understanding Current Mortgage Rate Landscape in 2026

The mortgage market in 2026 is giving homebuyers something they haven't seen in years: stability and relatively favorable rates. Let's break down what's actually happening with mortgage rates right now, because understanding the current landscape is absolutely essential when evaluating the 15-Year vs 30-Year Mortgage Rates in 2026: Which is Best for Long-Term Savings?.

Where Rates Stand Today

As of February 9, 2026, the mortgage rate environment looks remarkably different from the chaos of 2023-2024. Here's the current snapshot:

- 30-year fixed-rate mortgages: Averaging 5.99%[3]

- 15-year fixed-rate mortgages: Averaging 5.37%[3]

- Rate differential: A 0.62 percentage point spread between the two loan terms[3]

This represents a significant improvement from where we were just a year ago. In February 2025, 30-year mortgage rates hovered around 7.02%[2][3]—meaning today's rates are approximately one full percentage point lower. That's not just a statistical improvement; it's real money back in homebuyers' pockets every single month.

What's Driving These Rates?

The Federal Reserve has been playing it cool—literally keeping their benchmark interest rate steady in early February 2026 with no additional rate cuts expected in the immediate future[2]. This measured approach has created what industry insiders are calling a "Goldilocks zone" for mortgage rates: not too high to freeze out buyers, not so low that we're back to the unsustainable frenzy of 2020-2021.

Fannie Mae's January 2026 Housing Forecast predicts mortgage rates will settle at approximately 6% for most of 2026 and 2027[2]. Some industry analysts are even more optimistic, suggesting rates could dip below 6% later in 2026[4], though that remains speculative territory. The key takeaway? We're experiencing relative stability—rates have remained consistent for most of January and February 2026, with minimal week-to-week volatility[3].

For context on how these rates impact your overall home buying strategy, check out our guide on Best Mortgage Options for Gen Z Home Buyers 2026 Guide.

Real-World Payment Impact

Let's make this concrete. The median existing home price in December 2025 was $405,400[2]. With a standard 20% down payment and a 30-year mortgage at 6.23% (the early February rate), your monthly principal and interest payment would be approximately $1,993—about 23% of typical family income[2].

Now, here's where it gets interesting. For a $405,000 loan (assuming 25% down) at 6.625%, the estimated 30-year monthly payment is $2,594[1]. Switch to a 15-year mortgage, and you're looking at roughly $2,832-2,900 per month—but you're also cutting your total interest costs by an extraordinary amount.

Pro Tip: Current rates are near 3-year lows. If you've been gatekeeping your home buying plans waiting for the "perfect" rate, 2026 might be your moment to let it cook.

The Real Math: 15-Year vs 30-Year Mortgage Payment Breakdown

Numbers don't lie, but they can definitely surprise you. When comparing the 15-Year vs 30-Year Mortgage Rates in 2026: Which is Best for Long-Term Savings?, the monthly payment difference is just the tip of the iceberg. The real story is in the total cost of homeownership over time—and that's where things get absolutely wild.

Monthly Payment Reality Check

Let's use real data from U.S. Bank to illustrate the monthly payment trade-off[1]. When comparing a 15-year mortgage to a 20-year mortgage (the principle applies even more dramatically when comparing to 30-year terms):

- 15-year mortgage: Costs approximately $238 more per month than a 20-year mortgage

- Total interest savings: A staggering $34,790 over the life of the loan[1]

Now, when we extend that comparison to a full 30-year term, the numbers become even more impeccable. Here's a breakdown using current 2026 rates:

| Loan Term | Interest Rate | Monthly Payment (P&I)* | Total Interest Paid | Total Cost |

|---|---|---|---|---|

| 15-Year | 5.37% | ~$2,900 | ~$162,000 | ~$486,000 |

| 30-Year | 5.99% | ~$2,594 | ~$309,840 | ~$633,840 |

*Based on $324,000 loan amount (20% down on $405,000 home)

That's a difference of approximately $147,840 in total interest costs. Read that again. By choosing the 15-year option, you're essentially saving enough money to buy another modest home in many U.S. markets—or fund a very comfortable retirement.

The Break-Even Analysis You Need to See

Here's where the decision gets nuanced. Yes, you're paying $300+ more per month with a 15-year mortgage, but you're also building equity at a much faster rate. The break-even question becomes: "How long do I need to stay in this home for the 15-year option to make financial sense?"

For most scenarios, the break-even point occurs around year 7-8. Here's why:

-

Equity acceleration: In the first 5 years of a 30-year mortgage, you're paying mostly interest. With a 15-year mortgage, you're building equity from day one at a much faster pace.

-

Opportunity cost: The $300/month difference could theoretically be invested elsewhere, but historically, the guaranteed "return" of interest savings on a 15-year mortgage outperforms most conservative investment strategies.

-

Refinancing flexibility: If rates drop significantly (as some analysts predict they might later in 2026[4]), 15-year mortgage holders have more equity to leverage for refinancing opportunities.

If you're still deciding whether buying makes sense in the current market, our article on Will You Rent Or Buy In 2026? Surprising Real Estate Trends offers fresh perspective.

Hidden Costs and Savings

Beyond the obvious interest savings, 15-year mortgages offer some so based advantages that don't always make it into the marketing materials:

15-Year Mortgage Advantages:

- 💰 Lower total closing costs (you're borrowing for half the time)

- 🏠 Faster equity building (own your home outright by your early 50s if you buy in your 30s)

- 📉 Less exposure to market volatility (you're debt-free faster)

- 💪 Forced savings discipline (higher payments = automatic wealth building)

30-Year Mortgage Advantages:

- 📊 Cash flow flexibility (lower payments free up money for investments, emergencies, or lifestyle)

- 🎯 Easier qualification (lower payment requirements mean more people can afford to buy)

- 💡 Investment opportunity (the payment difference could be invested in higher-return vehicles)

- 🛡️ Financial cushion (lower required payment provides breathing room during income disruptions)

Real-World Scenario: The Johnson Family

Let's make this personal. Meet the hypothetical Johnson family—they're looking at purchasing a $405,000 home with 20% down, leaving them with a $324,000 mortgage.

Scenario A: 30-Year Mortgage at 5.99%

- Monthly payment: $2,594

- Total interest over 30 years: $309,840

- Home owned outright: 2056

Scenario B: 15-Year Mortgage at 5.37%

- Monthly payment: $2,900

- Total interest over 15 years: $162,000

- Home owned outright: 2041

The Johnsons would pay an extra $306 per month, but they'd save $147,840 in interest and own their home 15 years earlier. If they're both 35 years old, choosing the 15-year option means they own their home outright at 50 instead of 65—right when many people are thinking about retirement.

For more insights on navigating the current market, explore our comprehensive Mortgage Options & Real Estate Market Trends for New Buyers 2025.

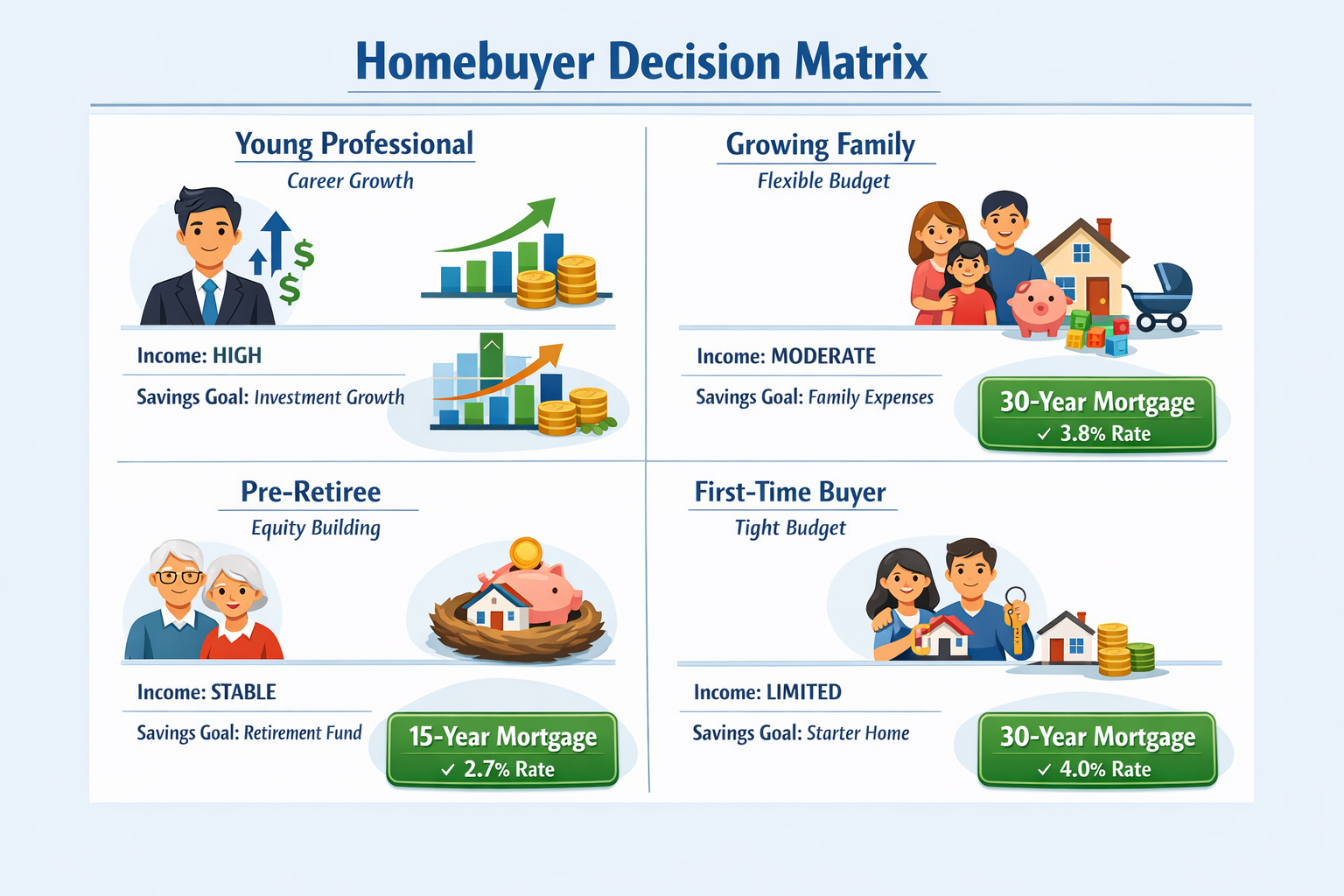

Who Should Choose Which Mortgage? Decision Framework for 2026

The question isn't really "which mortgage is better?"—it's "which mortgage is better for you?" When evaluating the 15-Year vs 30-Year Mortgage Rates in 2026: Which is Best for Long-Term Savings?, your personal financial situation, career trajectory, and life goals matter far more than any generic advice. Let's break down the decision framework so you can make an extraordinary choice for your unique circumstances.

Choose a 15-Year Mortgage If…

You're in Your Peak Earning Years

If you're in your 40s or 50s with an established career and stable income, a 15-year mortgage makes impeccable sense. You're likely earning more than you ever have, and you want to be mortgage-free before retirement. The higher monthly payment won't strain your budget, and the interest savings will boost your retirement nest egg significantly.

Example Profile: Sarah, 42, is a real estate broker earning $180,000 annually. Her kids are in middle school, and she's looking at college expenses in 5-7 years. By choosing a 15-year mortgage, she'll own her home outright by 57—right when she might want to scale back her work hours or transition to a less demanding role.

You Have Minimal Other Debt

If you've already paid off student loans, car payments, and credit cards, you have the cash flow capacity to handle higher mortgage payments. Without competing debt obligations, the 15-year mortgage becomes a forced savings vehicle that builds wealth faster than almost any other strategy.

You're Risk-Averse About Long-Term Debt

Some people genuinely lose sleep over carrying debt. If the thought of being 30 years into a mortgage makes you uncomfortable, the 15-year option provides peace of mind. You'll build equity faster, have more financial flexibility sooner, and reduce your exposure to potential market downturns or personal financial setbacks.

You Plan to Stay Long-Term

If you've found your "forever home" or at least plan to stay put for 10+ years, the 15-year mortgage's break-even analysis works strongly in your favor. You'll recoup the higher monthly payments through equity building and interest savings, especially in the later years of the loan.

For investment property considerations, our guide on Maximize Your Profits with Expert Real Estate Investment Property Management offers complementary strategies.

Choose a 30-Year Mortgage If…

You're Early in Your Career

If you're in your 20s or early 30s, your income likely has significant growth potential ahead. A 30-year mortgage keeps your monthly obligations manageable while your career develops. You can always make extra principal payments when you get raises or bonuses, effectively creating a hybrid approach.

Example Profile: Marcus, 28, is a first-time homebuyer working in tech sales. His base salary is $75,000, but his income could double in the next 5-7 years as he advances. The lower 30-year payment at $2,594 keeps his housing costs at a comfortable 35% of his current income, while the 15-year payment at $2,900 would stretch him too thin.

You Value Investment Flexibility

If you're financially sophisticated and believe you can earn higher returns investing the payment difference elsewhere, the 30-year mortgage provides that flexibility. The $300+ monthly difference between a 15-year and 30-year mortgage, invested consistently in index funds or real estate investment trusts, could potentially outperform the guaranteed "return" of interest savings—though this requires discipline and market timing.

You Need Cash Flow for Other Goals

Maybe you're saving for your kids' education, building an emergency fund, or investing in a business. The lower 30-year payment frees up cash for these competing priorities. Remember: you can always pay extra toward principal when you have surplus cash, but you can't lower your required payment if you overcommit to a 15-year mortgage.

You're Buying in an Uncertain Market

If you're purchasing in a market where you might relocate for work, or if you're unsure about the neighborhood's long-term prospects, the 30-year mortgage provides an exit strategy. Lower payments make the home easier to rent if you need to move, and you're not locked into the higher payment commitment of a 15-year loan.

For strategies on finding the right home in 2026's market, check out Best Home Buying Sites in the U.S. for 2026 | Expert Ranking.

The Hybrid Approach: Best of Both Worlds?

Here's a strategy that's so based, many financial advisors don't even mention it: Take the 30-year mortgage, but pay it like a 15-year.

How it works:

- Qualify for a 30-year mortgage at 5.99% (lower required payment)

- Voluntarily make payments equivalent to a 15-year mortgage (or more)

- Apply extra payments directly to principal

- Maintain flexibility to drop back to the minimum payment if needed

The advantages:

- ✅ Safety net: If you lose your job or face financial hardship, your required payment is lower

- ✅ Flexibility: You control how much extra you pay each month

- ✅ Qualification ease: Lower payment requirements make it easier to qualify for the loan

- ✅ Interest savings: Extra principal payments reduce total interest nearly as much as a true 15-year mortgage

The disadvantages:

- ❌ Requires discipline: You must actually make the extra payments consistently

- ❌ Slightly higher rate: You're stuck with the 30-year rate (5.99% vs 5.37%)

- ❌ Temptation factor: It's easy to rationalize skipping extra payments for "just this month"

Decision Matrix: Quick Reference Guide

| Your Situation | Best Choice | Why |

|---|---|---|

| Age 25-35, growing income | 30-year | Flexibility for career growth |

| Age 40-55, stable high income | 15-year | Maximize savings, retire debt-free |

| First-time buyer, tight budget | 30-year | Lower payment, easier qualification |

| Significant other debts | 30-year | Cash flow for debt paydown |

| Forever home, long-term stay | 15-year | Break-even works in your favor |

| Uncertain job/location | 30-year | Flexibility and lower commitment |

| Risk-averse personality | 15-year | Peace of mind, faster equity |

| Investment-savvy, disciplined | 30-year (hybrid approach) | Optimize returns across portfolio |

The Refinancing Wild Card

Here's where 2026 gets interesting. With Fannie Mae predicting rates will settle around 6% for 2026-2027[2], and some analysts suggesting rates could drop below 6% later this year[4], there's a legitimate refinancing strategy to consider:

Strategy: Take a 30-year mortgage now at 5.99%, then refinance to a 15-year mortgage if rates drop to 5.25% or lower later in 2026 or early 2027.

The math: You maintain cash flow flexibility in the short term, then lock in extraordinary long-term savings when rates are most favorable. This approach requires monitoring the market and being willing to go through the refinancing process, but it could save you thousands compared to committing to either option right now.

For more on timing your home purchase in the current market, our analysis on Master the 2025 Housing Market: Expert Insights provides valuable context.

Questions to Ask Yourself Before Deciding

Before you sign on the dotted line, get real with yourself about these questions:

- Income stability: How secure is your job? Do you have 6-12 months of expenses saved?

- Career trajectory: Is your income likely to increase, decrease, or stay flat over the next 5-10 years?

- Life plans: Are you planning to have kids, start a business, or make other major financial commitments?

- Risk tolerance: Would a higher required payment stress you out, or would long-term debt keep you up at night?

- Time horizon: How long do you realistically plan to stay in this home?

- Other financial goals: What else are you trying to accomplish financially in the next 15-30 years?

Your answers to these questions matter far more than any generic mortgage calculator or one-size-fits-all advice.

Strategic Refinancing Opportunities and Future Rate Predictions

The mortgage rate story for 2026 isn't just about what's happening today—it's about where rates are headed and how savvy homebuyers can position themselves to capitalize on future opportunities. Understanding the refinancing landscape is crucial when evaluating the 15-Year vs 30-Year Mortgage Rates in 2026: Which is Best for Long-Term Savings?, because your decision today might not be your final decision.

What the Experts Are Predicting

Let's cut through the noise and look at what credible sources are actually forecasting for mortgage rates:

Fannie Mae's Official Forecast (January 2026): Mortgage rates will settle at approximately 6% for most of 2026 and 2027[2]. This is the most conservative and arguably most reliable prediction, coming from one of the largest mortgage backers in the United States.

Optimistic Analyst Predictions: Some industry analysts suggest rates could decline below 6% later in 2026[4], potentially dropping to the 5.5-5.75% range for 30-year mortgages and 4.9-5.2% for 15-year mortgages.

The Federal Reserve Factor: With the Fed holding its benchmark interest rate steady in early February 2026 and signaling no additional rate cuts in the near term[2], any significant rate drops will likely come from market forces rather than Fed policy changes.

Reality check: We're experiencing minimal week-to-week volatility right now[3], which suggests the market has found a comfortable equilibrium. Dramatic rate drops are possible but not guaranteed.

When Refinancing Makes Sense

Refinancing isn't free—it typically costs 2-5% of your loan amount in closing costs. So when does it make financial sense to refinance your mortgage?

The Traditional Rule: Refinance when you can reduce your rate by at least 0.75-1.0 percentage points and you plan to stay in the home long enough to recoup closing costs.

2026 Refinancing Scenarios:

Scenario 1: The Rate Drop Play

- Current situation: 30-year mortgage at 5.99%

- Future opportunity: Rates drop to 5.25% later in 2026

- Savings: ~$150/month on a $324,000 loan

- Break-even: ~18-24 months (depending on closing costs)

- Verdict: ✅ Worth it if you plan to stay 3+ years

Scenario 2: The Term Switch

- Current situation: 30-year mortgage at 5.99%

- Future opportunity: Refinance to 15-year at 4.9%

- Monthly payment increase: ~$200-250

- Total interest savings: $100,000+

- Verdict: ✅ Extraordinary value if your income has increased and you can handle the higher payment

Scenario 3: The Equity Acceleration

- Current situation: 15-year mortgage at 5.37%

- Future opportunity: Rates drop to 4.75% for 15-year

- Savings: ~$120/month on a $324,000 loan

- Break-even: ~24-30 months

- Verdict: ⚠️ Maybe – depends on how much principal you've already paid down and closing cost negotiations

The Refinancing Calculator You Need

Here's a simple framework to determine if refinancing makes sense:

Step 1: Calculate your monthly savings

- New payment – Old payment = Monthly savings

Step 2: Estimate closing costs

- Typically 2-5% of loan amount

- For $324,000 loan: $6,480 – $16,200

Step 3: Calculate break-even point

- Closing costs ÷ Monthly savings = Break-even months

Step 4: Apply the stay-duration test

- If you'll stay in the home at least 2x the break-even period, refinancing likely makes sense

Example:

- Monthly savings: $150

- Closing costs: $8,000

- Break-even: 53 months (4.4 years)

- Stay duration test: Need to stay at least 8-9 years

- Decision: Refinance if you're confident you'll stay that long

Monitoring Rate Triggers

So how do you know when rates have dropped enough to consider refinancing? Set up these monitoring systems:

Weekly Rate Checks: Bookmark reliable sources like Bankrate or Freddie Mac's Primary Mortgage Market Survey. Check rates every Thursday (when most weekly data is released).

Rate Alert Threshold: Set a mental (or actual) alert for when 30-year rates drop to 5.5% or 15-year rates hit 4.9%. At those levels, it's time to seriously run the refinancing numbers.

Lender Relationships: Stay in touch with 2-3 mortgage lenders. Many offer free refinancing consultations and will proactively reach out when rates drop significantly.

Automated Tools: Use mortgage rate tracking apps or email alerts from sites like Zillow or Bankrate to get notified when rates hit your target threshold.

The 2026-2027 Refinancing Strategy

Here's a fresh approach that's gaining traction among financially savvy homebuyers:

Phase 1 (Now – Mid 2026): Lock in a 30-year mortgage at current rates (5.99%). This gives you:

- Lower monthly payment

- Easier qualification

- Maximum flexibility

Phase 2 (Late 2026 – Early 2027): Monitor for rate drops below 5.5% for 30-year or 4.9% for 15-year mortgages.

Phase 3 (When Rates Drop): Refinance to a 15-year mortgage at the lower rate, capturing:

- The lower rate environment

- The shorter term for accelerated equity building

- Total interest savings that could exceed $150,000

Why this works: You're not betting on rates dropping—you're positioning yourself to take advantage if they do, while maintaining flexibility if they don't. It's a low-risk, high-reward strategy that's so based it should be taught in personal finance classes.

Refinancing Pitfalls to Avoid

Not all refinancing opportunities are created equal. Watch out for these common traps:

🚫 The Reset Trap: Refinancing a 30-year mortgage after 5 years into a new 30-year mortgage resets your amortization schedule. You'll pay more total interest even with a lower rate.

🚫 The Cash-Out Temptation: Using refinancing to pull cash out of your home equity for non-investment purposes (vacations, cars, consumer goods) is financial self-sabotage.

🚫 The Points Game: Paying points to buy down your rate only makes sense if you'll stay in the home long enough to recoup the upfront cost through monthly savings.

🚫 The ARM Gamble: Switching to an adjustable-rate mortgage (ARM) to get a lower initial rate can backfire spectacularly if rates rise during the adjustment period.

Building Your Refinancing War Chest

If you're planning to potentially refinance in the next 12-24 months, start preparing now:

- Improve your credit score: Every 20-point increase can save you 0.1-0.25% on your rate

- Document income growth: Lenders love to see stable or increasing income

- Build equity: The more equity you have, the better your refinancing terms

- Reduce debt-to-income ratio: Pay down other debts to qualify for better rates

- Shop multiple lenders: Get at least 3-5 quotes when you're ready to refinance

For additional insights on optimizing your financial position, explore our guide on Fast-Track Your Homeownership with Pre-Approval & Market Trends.

The Bottom Line on Refinancing

Refinancing is a powerful tool, but it's not automatic. The 15-Year vs 30-Year Mortgage Rates in 2026: Which is Best for Long-Term Savings? question extends beyond your initial mortgage choice—it includes your willingness and ability to refinance when conditions are favorable.

The impeccable strategy? Choose the mortgage that works for your situation today, but stay informed and ready to refinance when opportunities arise. Don't let gatekeeping financial "experts" convince you there's only one right answer. Your mortgage strategy should evolve as your financial situation and market conditions change.

Conclusion: Making Your Extraordinary Mortgage Decision in 2026

After breaking down the numbers, scenarios, and strategies around the 15-Year vs 30-Year Mortgage Rates in 2026: Which is Best for Long-Term Savings?, here's the truth: there's no universal "best" choice—only the best choice for your unique financial situation, goals, and risk tolerance.

The Clear Winners

Choose a 15-year mortgage if you're established in your career, have stable income, minimal other debt, and want to build wealth through forced equity accumulation. The current rate of 5.37%[3] combined with the extraordinary interest savings (potentially $100,000-150,000+ over the loan term) makes this an impeccable choice for those who can handle the higher monthly payment.

Choose a 30-year mortgage if you're early in your career, value cash flow flexibility, have competing financial priorities, or want the safety net of a lower required payment. The current rate of 5.99%[3] is still historically favorable, and the flexibility to invest the payment difference elsewhere—or simply maintain a comfortable lifestyle—shouldn't be underestimated.

Consider the hybrid approach if you want the best of both worlds: take the 30-year mortgage for qualification ease and payment flexibility, but make extra principal payments to accelerate equity building and reduce total interest costs.

Your Action Plan for 2026

Step 1: Run Your Numbers

Use the frameworks and examples provided in this article to calculate your specific monthly payments, total interest costs, and break-even points. Don't rely on generic advice—make this personal.

Step 2: Assess Your Risk Tolerance

Be honest about your comfort level with higher required payments versus long-term debt. Your peace of mind matters as much as the math.

Step 3: Consider Your Timeline

If you're planning to stay in the home for 10+ years, the 15-year mortgage's benefits compound significantly. If you might move in 5-7 years, the 30-year option provides more flexibility.

Step 4: Monitor Refinancing Opportunities

Set up rate alerts and maintain relationships with 2-3 lenders. With predictions suggesting rates could drop below 6% later in 2026[4], refinancing opportunities may present themselves sooner than you think.

Step 5: Consult with Professionals

Talk to licensed mortgage brokers, financial advisors, and real estate professionals who understand your local market. Real Estate Rank IQ provides expert-backed guidance from licensed brokers with over 15 years of experience—use that expertise to inform your decision.

The Fresh Perspective

The mortgage market in 2026 is offering something we haven't seen in years: reasonable rates with minimal volatility. Whether you choose the 15-year path to accelerated equity building or the 30-year route to cash flow flexibility, you're making your decision in a relatively favorable environment.

Current rates are near 3-year lows[2][3], approximately one percentage point lower than just a year ago. That's not just a statistic—it's a genuine opportunity to lock in financing that could save you tens of thousands of dollars compared to buyers who purchased in 2023-2024.

Let It Cook

Don't rush this decision. Take the time to run the numbers, consider your goals, and evaluate your options. The difference between a 15-year and 30-year mortgage isn't just about monthly payments—it's about your entire financial trajectory over the next 15-30 years.

Use the decision frameworks, payment calculators, and refinancing strategies outlined in this article to make an informed choice. And remember: your mortgage choice isn't necessarily permanent. With strategic refinancing, you can adjust your approach as your financial situation evolves and market conditions change.

Connect with Real Estate Rank IQ

For more expert guidance on navigating the 2026 real estate market, mortgage strategies, and investment opportunities, visit Real Estate Rank IQ or subscribe to our YouTube channel @Realestaterankiq. Our licensed brokers with over 15 years of experience provide clear, step-by-step guidance on home buying, selling, and investment strategies.

Have questions about your specific mortgage situation? Reach out to our team at news@realestaterankiq.com—we're here to help you make the extraordinary choice for your financial future.

The 15-Year vs 30-Year Mortgage Rates in 2026: Which is Best for Long-Term Savings? question has one definitive answer: the one that aligns with your goals, supports your lifestyle, and sets you up for long-term financial success. Now you have the knowledge and frameworks to make that decision with confidence.

References

[1] 15 Vs 30 Year Mortgage Calculator – https://www.usbank.com/home-loans/mortgage/mortgage-calculators/15-vs-30-year-mortgage-calculator.html

[2] Mortgage Rates February 4 2026 – https://www.bankrate.com/mortgages/analysis/mortgage-rates-february-4-2026/

[3] Todays Mortgage Interest Rates February 9 2026 – https://www.cbsnews.com/news/todays-mortgage-interest-rates-february-9-2026/

[4] Watch – https://www.youtube.com/watch?v=KazwK5zF21s