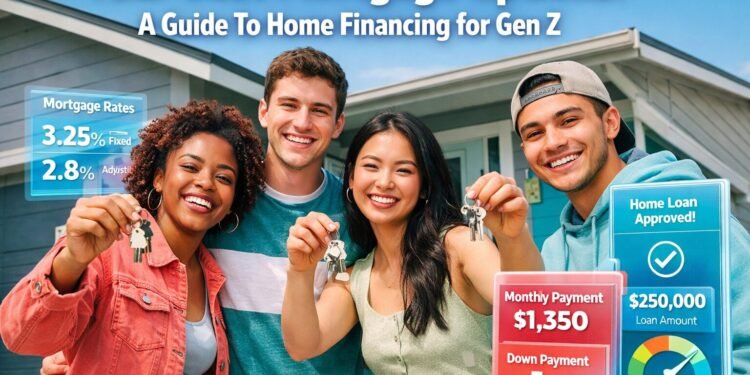

Let's be real—scrolling through TikTok watching Millennials complain about never affording a home while you're trying to figure out your best mortgage options: a guide to home financing for Gen Z hits different. The housing market in 2026 isn't exactly giving "affordable starter home" energy, but here's the thing: Gen Z is already rewriting the playbook on homeownership. While older generations are gatekeeping traditional wisdom about waiting until your 30s or needing a 20% down payment, savvy Gen Zers are leveraging technology, alternative financing, and government programs to unlock doors (literally) that seemed permanently closed. This comprehensive guide breaks down everything you need to know about mortgages without the financial jargon that makes your eyes glaze over—because understanding your best mortgage options: a guide to home financing for Gen Z is the first step toward building generational wealth, not just renting forever.

Key Takeaways 🔑

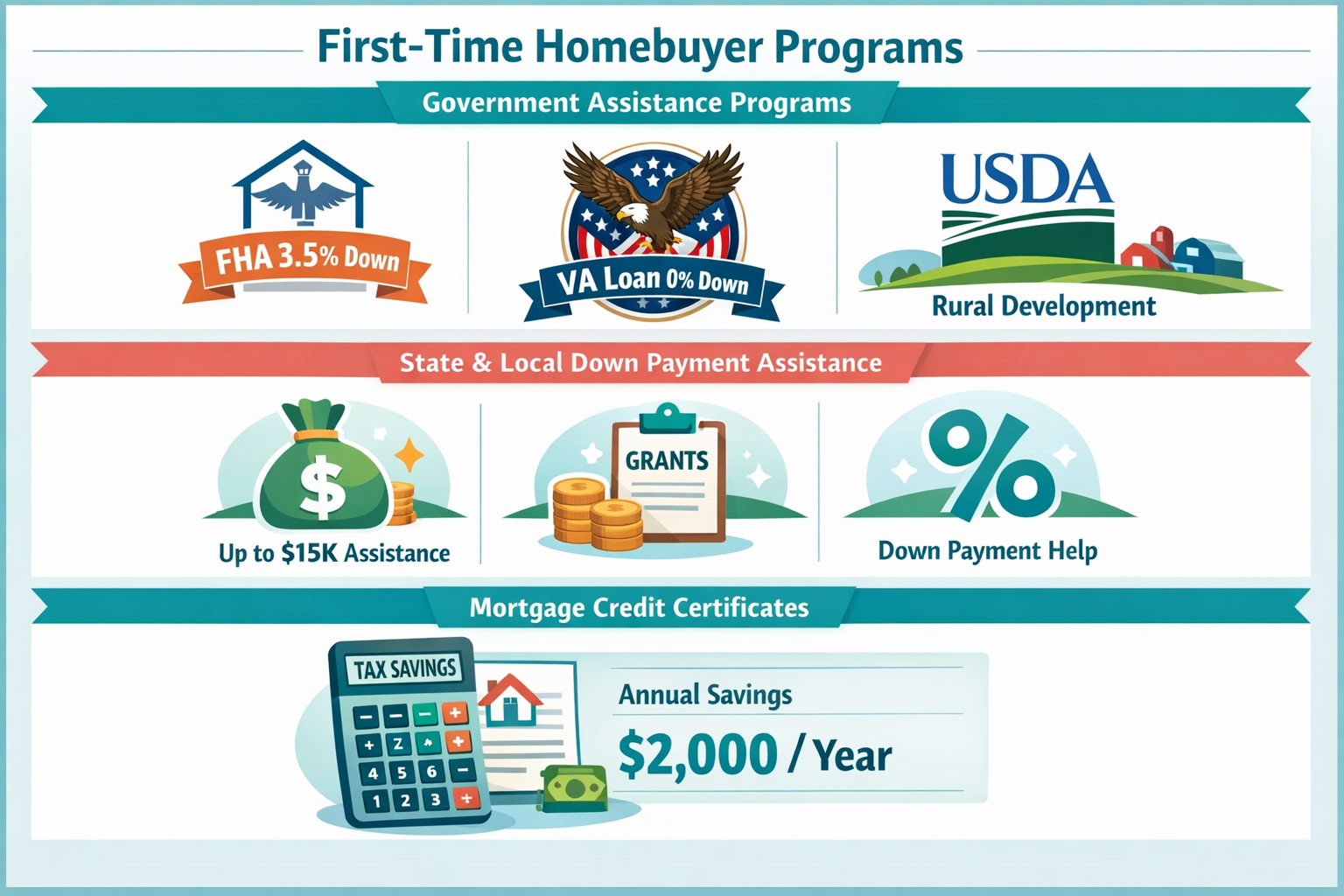

- Low down payment options exist: FHA loans require as little as 3.5% down, while VA and USDA loans offer 0% down payment options for qualified buyers

- Credit scores matter, but aren't everything: While conventional loans prefer 620+, FHA loans accept scores as low as 580, and some programs work with even lower scores

- First-time buyer programs are extraordinary: Federal, state, and local assistance programs can provide thousands in down payment help and tax credits

- Pre-approval is non-negotiable: Getting pre-approved before house hunting gives you negotiating power and shows sellers you're serious in the competitive 2026 market

- Tech tools level the playing field: AI-powered mortgage calculators and comparison platforms help Gen Z buyers make data-driven decisions faster than ever

Understanding the 2026 Mortgage Landscape for Gen Z Buyers

The mortgage game in 2026 looks wildly different than it did for your parents. Interest rates have stabilized after the volatility of the early 2020s, but they're still higher than the historic lows Millennials enjoyed. However, that doesn't mean homeownership is off the table—it just means Gen Z needs to be strategic, informed, and ready to leverage every advantage available.

According to the 2026 housing market analysis, median home prices have continued their upward trajectory, but so have wages in many sectors where Gen Z dominates. The key is understanding that traditional mortgage advice—like saving 20% down or waiting until you're "financially stable"—was designed for a different economic reality.

Why Gen Z Faces Unique Challenges (and Opportunities)

The Challenges:

- 📊 Student loan debt: The average Gen Z college graduate carries significant educational debt

- 💰 Higher home prices: Starter homes in desirable areas often exceed $300K

- 📈 Interest rate environment: Rates hovering between 6-7% versus the 3% rates of 2020-2021

- 🏢 Gig economy income: Non-traditional employment can complicate mortgage approval

The Opportunities:

- 🤖 Technology advantage: Gen Z's digital fluency makes navigating online mortgage platforms effortless

- 💡 Financial literacy: Growing up during economic uncertainty created a generation that researches before purchasing

- 🌐 Remote work flexibility: Location independence opens up affordable markets previously off-limits

- 🎯 First-time buyer programs: More assistance programs than ever specifically target younger buyers

The dope thing about being a Gen Z homebuyer? You're not afraid to use technology to your advantage. From AI hacks to beat house hunting fatigue to leveraging social media for real estate research, this generation approaches homebuying with fresh eyes and innovative strategies.

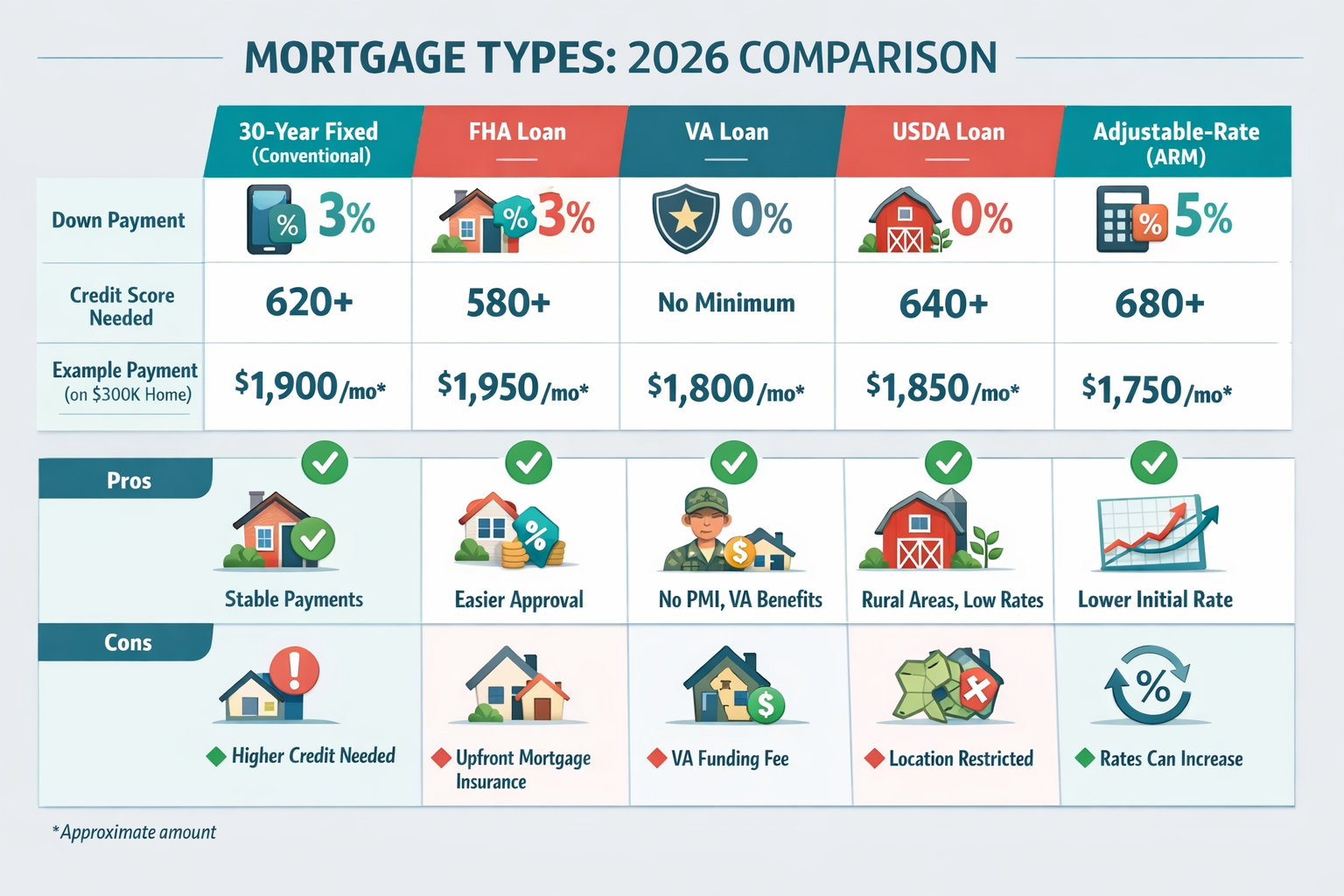

Your Best Mortgage Options: A Guide To Home Financing for Gen Z – The Main Types Explained

Understanding the different mortgage types is crucial for making an informed decision. Each option comes with specific requirements, benefits, and drawbacks. Let's break down your best mortgage options: a guide to home financing for Gen Z with the most common loan types you'll encounter.

Conventional Loans: The Traditional Route

What they are: Mortgages not backed by the government, typically offered by banks, credit unions, and mortgage companies.

Key Requirements:

- 💳 Credit score: Minimum 620, but 740+ gets you the best rates

- 💵 Down payment: As low as 3% for first-time buyers (Conventional 97 program)

- 📊 Debt-to-income ratio: Generally 43% or lower

- 🏦 Private Mortgage Insurance (PMI): Required if down payment is less than 20%

Best for: Gen Z buyers with solid credit, stable employment, and some savings who want flexibility in property type and location.

The Real Talk: Conventional loans offer the most flexibility but require the strongest financial profile. If you've been building credit since college and have a steady W-2 job, this might be your path. The PMI requirement isn't ideal, but it's removable once you hit 20% equity—unlike FHA loans where mortgage insurance can stick around for the life of the loan.

FHA Loans: The Accessible Option

What they are: Federal Housing Administration-insured loans designed to help buyers with lower credit scores and smaller down payments.

Key Requirements:

- 💳 Credit score: 580 for 3.5% down; 500-579 requires 10% down

- 💵 Down payment: As low as 3.5%

- 📊 Debt-to-income ratio: Up to 50% may be acceptable

- 🏦 Mortgage Insurance Premium (MIP): Upfront (1.75%) plus annual premium

Best for: Gen Z buyers with limited savings, lower credit scores, or higher debt-to-income ratios who need accessible entry into homeownership.

The Real Talk: FHA loans are impeccable for first-time buyers who don't have perfect credit or a massive down payment saved. The catch? That mortgage insurance premium sticks around for the life of the loan if you put down less than 10%, which can add hundreds to your monthly payment. Still, for many Gen Zers, it's the difference between renting forever and building equity now.

VA Loans: Military Benefits That Are So Based

What they are: Loans guaranteed by the Department of Veterans Affairs for eligible service members, veterans, and surviving spouses.

Key Requirements:

- 💳 Credit score: No official minimum (lenders typically want 620+)

- 💵 Down payment: 0% down payment required

- 📊 Certificate of Eligibility: Must prove military service eligibility

- 🏦 Funding fee: One-time fee (waived for disabled veterans)

Best for: Gen Z military members or veterans—this is literally one of the best benefits available.

The Real Talk: If you qualify for a VA loan, use it. Zero down payment, no PMI, competitive interest rates, and flexible credit requirements make this an extraordinary option. The funding fee ranges from 1.4% to 3.6% depending on down payment and whether it's your first VA loan, but it can be rolled into the loan amount.

USDA Loans: Rural and Suburban Opportunities

What they are: U.S. Department of Agriculture loans for properties in eligible rural and suburban areas.

Key Requirements:

- 💳 Credit score: Typically 640 minimum

- 💵 Down payment: 0% down payment required

- 📊 Income limits: Must not exceed 115% of area median income

- 🏦 Property location: Must be in USDA-eligible area

Best for: Gen Z buyers open to living outside major metro areas who meet income requirements.

The Real Talk: Don't let "rural" fool you—many suburban areas qualify for USDA loans. If you're working remotely or don't mind a commute, this zero-down option opens up affordable markets. The income limits can be restrictive in high-cost areas, but in many regions, they're generous enough to include middle-income earners.

Adjustable-Rate Mortgages (ARMs): The Strategic Play

What they are: Mortgages with interest rates that adjust periodically based on market conditions, typically starting with a fixed period (5/1, 7/1, 10/1 ARMs).

Key Requirements:

- 💳 Credit score: Generally 620+ (higher for best rates)

- 💵 Down payment: Typically 5-20% depending on lender

- 📊 Financial stability: Lenders scrutinize ability to afford potential rate increases

- 🏦 Rate caps: Annual and lifetime caps limit how much rates can increase

Best for: Gen Z buyers planning to sell or refinance within 5-10 years, or those expecting significant income growth.

The Real Talk: ARMs got a bad reputation during the 2008 housing crisis, but they can be strategic tools when used correctly. If you're planning to relocate for career advancement in a few years or expect your income to increase substantially, the lower initial rate can save thousands. Just make sure you understand the rate adjustment schedule and can afford potential increases.

Comparing Mortgage Options: Which Is Right for Your Situation?

Choosing among your best mortgage options: a guide to home financing for Gen Z requires honest assessment of your financial situation, future plans, and risk tolerance. Here's a practical comparison framework:

| Loan Type | Min. Credit Score | Min. Down Payment | Best For | Watch Out For |

|---|---|---|---|---|

| Conventional | 620 | 3% | Strong credit, stable income | PMI until 20% equity |

| FHA | 580 | 3.5% | Lower credit, limited savings | MIP for life of loan |

| VA | ~620 | 0% | Military/veterans | Funding fee (unless disabled) |

| USDA | 640 | 0% | Rural/suburban buyers | Income and location limits |

| ARM | 620+ | 5-20% | Short-term ownership plans | Rate adjustment risk |

Decision Framework: Ask Yourself These Questions

1. What's your credit score situation?

- 740+: Conventional loans will offer your best rates

- 620-739: Conventional still works, but compare with FHA

- 580-619: FHA is likely your best bet

- Below 580: Work on credit improvement or explore special programs

2. How much can you put down?

- 20%+: Conventional without PMI is fresh

- 10-19%: Conventional or FHA, run the numbers

- 3.5-9%: FHA or Conventional 97

- 0-3%: VA (if eligible), USDA (if location qualifies), or save more

3. What's your employment situation?

- W-2 employee, 2+ years: Any loan type works

- Self-employed/gig worker: Conventional or FHA with proper documentation

- New to workforce: FHA may be more forgiving

- Military/veteran: VA loan is your golden ticket

4. Where do you want to live?

- Urban core: Conventional or FHA

- Suburbs: All options available

- Rural areas: Check USDA eligibility

- High-cost area: Conventional conforming or jumbo

5. How long do you plan to stay?

- 5-7+ years: Fixed-rate conventional or FHA

- 3-5 years: Consider ARM for lower initial rate

- 10+ years: Fixed-rate for payment stability

- Uncertain: Fixed-rate provides flexibility

Understanding mortgage options in depth helps you make decisions that align with your financial goals rather than just accepting whatever your lender offers first.

First-Time Homebuyer Programs: Don't Leave Money on the Table

Here's where Gen Z can really win: first-time homebuyer programs are extraordinary resources that many people don't even know exist. These programs can provide down payment assistance, reduced interest rates, tax credits, and more—literally thousands of dollars in savings.

Federal First-Time Homebuyer Programs

FHA Loans (Already Covered)

The most popular federal option, but not the only one.

Good Neighbor Next Door Program

- 💰 Benefit: 50% discount on list price

- 🎯 Eligibility: Teachers, law enforcement, firefighters, EMTs

- 📍 Requirement: Must live in property for 36 months

- 🏘️ Locations: Designated revitalization areas

Fannie Mae HomeReady® and Freddie Mac Home Possible®

- 💰 Benefit: 3% down payment, flexible income sources

- 🎯 Eligibility: Income limits (typically 80% of area median)

- 📊 Advantage: Lower PMI costs than standard conventional

- 🎓 Bonus: Accepts non-traditional credit (rent, utilities)

Native American Direct Loan (NADL)

- 💰 Benefit: 0% down, no PMI

- 🎯 Eligibility: Native American veterans

- 📍 Requirement: Property on federal trust land

State and Local Down Payment Assistance Programs

Every state offers unique programs, and many cities and counties add their own. These can be game-changers:

Common Program Types:

- 💵 Grants: Free money that doesn't need repayment (up to $15K in some areas)

- 🏦 Second mortgages: Low or no-interest loans for down payment

- 🎁 Forgivable loans: Forgiven after living in home for specified period (typically 5-10 years)

- 💳 Tax credits: Mortgage Credit Certificates (MCCs) providing annual tax credits

How to Find Your State's Programs:

- Visit your state Housing Finance Agency website

- Check with your city or county housing department

- Ask your lender about local assistance programs

- Research employer-assisted housing programs

Many Gen Z buyers are shocked to discover they qualify for $5,000-$15,000 in down payment assistance. That's literally the difference between buying now versus saving for another 2-3 years while prices increase.

Employer-Assisted Housing Programs

Some forward-thinking employers offer housing benefits:

- 💼 Down payment assistance: Grants or loans for employees

- 🏢 Relocation assistance: Help with closing costs for relocating employees

- 🎓 Student loan assistance: Some companies help pay down debt to improve DTI ratios

- 💰 Housing stipends: Additional compensation for housing in expensive markets

Industries commonly offering these benefits:

- Technology companies

- Healthcare systems

- Educational institutions

- Government agencies

- Large corporations recruiting in high-cost areas

The first-time homebuyer guide provides additional strategies for navigating the purchase process beyond just financing.

Pre-Approval: Your Secret Weapon in Competitive Markets

Getting pre-approved for a mortgage before you start house hunting isn't just recommended—it's essential in the 2026 market. Pre-approval gives you a clear budget, shows sellers you're serious, and speeds up the closing process when you find the right property.

Pre-Approval vs. Pre-Qualification: Know the Difference

Pre-Qualification (The Basic Version):

- 📝 Based on self-reported information

- 🕐 Takes 15-30 minutes

- 💼 No credit check or documentation required

- 🎯 Gives rough estimate of borrowing power

- ⚠️ Not taken seriously by sellers

Pre-Approval (The Real Deal):

- 📝 Based on verified financial information

- 🕐 Takes 1-3 days

- 💼 Requires credit check, income verification, asset documentation

- 🎯 Provides specific loan amount and estimated rate

- ✅ Shows sellers you can actually close

In competitive markets, sellers won't even consider offers without pre-approval letters. It's like showing up to a job interview with your resume versus just saying "trust me, I'm qualified."

The Pre-Approval Process: Step by Step

Step 1: Gather Your Documentation 📄

- Last 2 years of W-2s or tax returns (self-employed)

- Recent pay stubs (last 30-60 days)

- Bank statements (last 2-3 months)

- List of debts (student loans, car payments, credit cards)

- Photo ID and Social Security card

- Explanation letters for any credit issues

Step 2: Check Your Credit 💳

- Pull your credit reports from all three bureaus (free at AnnualCreditReport.com)

- Review for errors and dispute inaccuracies

- Understand your credit score (most lenders use FICO scores)

- Avoid opening new credit accounts during the process

Step 3: Calculate Your Budget 💰

- Use the 28/36 rule: Housing costs ≤28% of gross income, total debt ≤36%

- Factor in property taxes, insurance, HOA fees, maintenance

- Leave room for emergency savings and lifestyle expenses

- Be honest about what payment you're comfortable with

Step 4: Shop Multiple Lenders 🏦

- Get quotes from at least 3-5 lenders (banks, credit unions, online lenders, mortgage brokers)

- Compare interest rates, fees, and closing costs

- Ask about rate lock periods and loan processing times

- Read reviews and check lender reputation

Step 5: Submit Your Application 📋

- Complete the Uniform Residential Loan Application (Form 1003)

- Provide all requested documentation

- Respond quickly to any follow-up requests

- Ask questions about anything you don't understand

Step 6: Receive Your Pre-Approval Letter ✉️

- Typically valid for 60-90 days

- Shows maximum loan amount approved

- May include estimated interest rate

- Can be updated or extended if needed

Pro Tips for Stronger Pre-Approval

Boost Your Approval Amount:

- 📈 Pay down debt: Reducing credit card balances improves DTI ratio

- 💰 Document all income: Include bonuses, side hustles, investment income

- 🏦 Increase down payment: Larger down payment = larger loan approval

- 👥 Add a co-borrower: Combined income increases buying power

Avoid These Pre-Approval Killers:

- ❌ Don't change jobs during the process (lenders want employment stability)

- ❌ Don't make large purchases (new car, furniture) that increase debt

- ❌ Don't open new credit cards (hard inquiries lower credit score)

- ❌ Don't make large deposits without documentation (lenders scrutinize unusual activity)

- ❌ Don't close old credit cards (reduces available credit, can lower score)

Understanding pre-approval pro tips can fast-track your path to homeownership by avoiding common mistakes that delay or derail approval.

Credit Scores and Down Payments: The Real Numbers You Need

Let's talk about the two biggest factors that determine your mortgage options: credit score and down payment. The internet is full of conflicting information, so here's the straight truth for 2026.

Credit Score Requirements: The Complete Breakdown

Your credit score impacts:

- ✅ Whether you get approved

- 💰 What interest rate you receive

- 🏦 Which loan programs you qualify for

- 💵 How much you can borrow

Credit Score Tiers and Impact:

| Score Range | Rating | Typical Rate Impact | Best Loan Options |

|---|---|---|---|

| 760+ | Excellent | Best rates available | All options, lowest rates |

| 700-759 | Good | +0.25-0.50% vs. excellent | All options, good rates |

| 660-699 | Fair | +0.50-1.00% vs. excellent | Conventional, FHA |

| 620-659 | Below Average | +1.00-1.50% vs. excellent | FHA, some conventional |

| 580-619 | Poor | +1.50-2.00% vs. excellent | FHA only |

| Below 580 | Very Poor | Very high or declined | FHA (10% down) or improve credit |

Real Dollar Impact Example:

On a $300,000 loan:

- 760 credit score @ 6.5%: $1,896/month

- 680 credit score @ 7.0%: $1,996/month

- 620 credit score @ 7.5%: $2,098/month

That's a $202/month difference ($2,424/year) between excellent and below-average credit—over $72,000 over a 30-year mortgage. So based.

Improving Your Credit Score Before Applying

Quick Wins (30-90 days):

- 💳 Pay down credit card balances below 30% of limits (ideally below 10%)

- 📧 Dispute credit report errors (30-45 day process)

- 💰 Become an authorized user on a family member's old, well-managed account

- 📅 Pay all bills on time (set up autopay to avoid missed payments)

- 🚫 Don't close old accounts (length of credit history matters)

Medium-Term Strategies (3-6 months):

- 🏦 Diversify credit types (if you only have credit cards, consider a small installment loan)

- 📊 Keep credit utilization low consistently

- ⏰ Let time work for you (negative items age off reports)

- 💳 Request credit limit increases (improves utilization ratio)

Long-Term Building (6-12+ months):

- 🔄 Establish payment history with rent, utilities, subscriptions

- 📈 Monitor credit regularly (Credit Karma, Credit Sesame, or bank apps)

- 🎯 Focus on score factors: Payment history (35%), credit utilization (30%), length of history (15%), new credit (10%), credit mix (10%)

Down Payment Requirements: Myth vs. Reality

The Myth: You need 20% down to buy a house.

The Reality: The median first-time homebuyer puts down just 6-7%, and many programs require far less.

Actual Down Payment Options:

Zero Down (0%):

- ✅ VA loans (veterans/military)

- ✅ USDA loans (eligible rural/suburban areas)

- ✅ Some state/local first-time buyer programs

- ✅ Navy Federal Credit Union (for members)

Low Down (3-3.5%):

- ✅ FHA loans (3.5% with 580+ credit)

- ✅ Conventional 97 (3% for first-time buyers)

- ✅ HomeReady/Home Possible (3% with income limits)

Standard Down (5-10%):

- ✅ Conventional loans (standard requirement)

- ✅ Jumbo loans (high-balance properties)

Traditional Down (20%+):

- ✅ Avoids PMI on conventional loans

- ✅ Better rates and terms

- ✅ Lower monthly payments

- ✅ More equity from day one

Down Payment Assistance: Where to Find Free Money

Sources of Down Payment Funds:

Gifted Funds:

Most loan programs allow down payment gifts from family members. Requirements:

- 📝 Gift letter stating no repayment expected

- 🏦 Documentation of fund transfer

- 💰 Donor must show source of funds

- 👥 Must be from family member (not friend or interested party)

Grants and Assistance Programs:

- 🏛️ Federal programs: Good Neighbor Next Door, Native American programs

- 🏢 State HFAs: Down payment assistance grants ($5K-$15K typical)

- 🏙️ Local programs: City and county housing initiatives

- 💼 Employer programs: Company-sponsored housing assistance

Creative Strategies:

- 🏠 Seller concessions: Negotiate seller-paid closing costs (up to 3-6% of purchase price)

- 💰 Retirement accounts: First-time buyers can withdraw $10K from IRA penalty-free

- 🎁 Crowdfunding: Some platforms allow family/friends to contribute to down payment fund

- 💳 Down payment loans: Some programs offer second mortgages for down payment

Saving Strategies for Gen Z:

- 📱 Automated savings apps: Acorns, Digit, Qapital round up purchases

- 🎯 High-yield savings accounts: Online banks offering 4-5% APY

- 💰 Side hustle dedicated account: Funnel gig income directly to down payment

- 🔄 Savings challenges: 52-week challenge, no-spend months, percentage-based saving

Making your home look expensive on a budget after purchase helps you build equity through smart improvements rather than overspending.

Interest Rates, Monthly Payments, and Total Cost: The Math That Matters

Understanding how interest rates impact your monthly payment and total cost over the life of the loan is crucial for making informed decisions. Small rate differences create massive long-term impacts.

How Interest Rates Work

The Basics:

- 📊 Interest rate = the cost of borrowing money, expressed as annual percentage

- 💰 APR (Annual Percentage Rate) = interest rate + fees and costs (more accurate comparison)

- 🔒 Fixed rate = stays the same for life of loan

- 📈 Adjustable rate = changes based on market conditions after initial fixed period

What Determines Your Rate:

- 💳 Credit score: Higher score = lower rate

- 💵 Down payment: Larger down payment = lower rate

- 🏦 Loan type: Government-backed loans may have different rates

- 📍 Property location: Some areas have higher rates

- 🏠 Property type: Investment properties and condos may have higher rates

- ⏰ Loan term: 15-year loans typically have lower rates than 30-year

- 📊 Market conditions: Federal Reserve policy, economic indicators

Payment Comparison: See the Difference

$300,000 Loan, 30-Year Fixed:

| Interest Rate | Monthly Payment | Total Interest Paid | Total Cost |

|---|---|---|---|

| 6.0% | $1,799 | $347,515 | $647,515 |

| 6.5% | $1,896 | $382,633 | $682,633 |

| 7.0% | $1,996 | $418,527 | $718,527 |

| 7.5% | $2,098 | $455,089 | $755,089 |

| 8.0% | $2,201 | $492,233 | $792,233 |

Key Insight: The difference between 6% and 8% is $402/month or $144,718 over 30 years. That's literally a second property's down payment.

15-Year vs. 30-Year Mortgages

30-Year Fixed:

- ✅ Lower monthly payments

- ✅ More budget flexibility

- ✅ Easier to qualify

- ❌ Pay significantly more interest

- ❌ Build equity slower

15-Year Fixed:

- ✅ Save massive amounts on interest

- ✅ Build equity faster

- ✅ Own home free and clear sooner

- ✅ Typically lower interest rates

- ❌ Higher monthly payments

- ❌ Less budget flexibility

Example: $300,000 Loan @ 6.5%

- 30-year: $1,896/month, $382,633 total interest

- 15-year: $2,613/month, $170,351 total interest

- Savings: $212,282 in interest (but $717 higher monthly payment)

The Gen Z Strategy:

Many savvy Gen Z buyers choose 30-year mortgages for the flexibility but make extra principal payments when possible—getting the best of both worlds.

Points and Buydowns: Should You Pay to Lower Your Rate?

Discount Points:

- 💰 Pay upfront to reduce interest rate

- 📊 1 point = 1% of loan amount = typically 0.25% rate reduction

- 🎯 Makes sense if you'll keep loan 5+ years

- 💵 Example: $3,000 (1 point on $300K) to reduce rate from 7% to 6.75%

Break-Even Analysis:

- Calculate monthly savings from lower rate

- Divide points cost by monthly savings

- Result = months to break even

- Stay longer than break-even = good deal

Temporary Buydowns:

- 🏦 2-1 buydown: Rate 2% lower year 1, 1% lower year 2, normal year 3+

- 💰 Seller or builder often pays for buydown

- 🎯 Good for buyers expecting income growth

- ⚠️ Payment shock when rate adjusts

Understanding investment financing helps if you're considering buying a rental property in addition to your primary residence.

The Application Process: From Pre-Approval to Closing

Once you've found your dream home and your offer is accepted, the real mortgage process begins. Here's what to expect and how to navigate it smoothly.

Timeline: What Happens When

Week 1-2: Application and Initial Processing

- 📝 Submit formal loan application

- 🏦 Lender orders appraisal and title search

- 📄 Provide additional documentation as requested

- 💰 Pay appraisal fee and application fees

Week 2-3: Underwriting

- 🔍 Underwriter reviews complete file

- 📊 Verifies employment, income, assets, credit

- 🏠 Reviews appraisal and property details

- ❓ May request additional documentation ("conditions")

Week 3-4: Conditional Approval

- ✅ Loan approved with conditions

- 📋 Submit required documentation to clear conditions

- 🔄 Final underwriting review

- 📅 Schedule closing date

Week 4-6: Clear to Close

- ✅ All conditions satisfied

- 📄 Final loan documents prepared

- 💰 Receive closing disclosure (3 days before closing)

- 🏦 Wire down payment and closing costs

Closing Day:

- 📝 Sign loan documents and closing papers

- 💵 Funds disbursed to seller

- 🔑 Receive keys to your new home!

Common Documentation Requests

Income Verification:

- Recent pay stubs (usually last 30 days)

- W-2s (last 2 years)

- Tax returns (last 2 years if self-employed)

- Bank statements showing deposits

- Explanation for any irregular income

Asset Verification:

- Bank statements (last 2-3 months)

- Investment account statements

- Retirement account statements

- Gift letters for down payment gifts

- Explanation for large deposits

Credit and Debt:

- Student loan statements

- Car loan documentation

- Credit card statements

- Explanation for any credit inquiries

- Letters of explanation for credit issues

Property Documentation:

- Purchase agreement

- Appraisal report

- Homeowners insurance quote

- HOA documents (if applicable)

- Inspection reports

Red Flags That Can Derail Your Loan

Employment Changes:

- ❌ Switching jobs during the process

- ❌ Going from W-2 to self-employed

- ❌ Taking unpaid leave

- ❌ Significant reduction in hours

Financial Changes:

- ❌ Opening new credit accounts

- ❌ Making large purchases

- ❌ Taking on new debt

- ❌ Large unexplained deposits or withdrawals

- ❌ Closing credit card accounts

Property Issues:

- ❌ Appraisal comes in low

- ❌ Major inspection issues

- ❌ Title problems

- ❌ Insurance unavailable or expensive

- ❌ Property doesn't meet lender standards

The Golden Rule: From application to closing, maintain the status quo. Don't change anything about your financial situation without consulting your loan officer first.

Closing Costs: What to Expect

Typical Closing Costs (2-5% of Purchase Price):

Lender Fees:

- 💰 Origination fee (0.5-1% of loan amount)

- 📋 Application fee ($300-$500)

- 🔍 Underwriting fee ($400-$800)

- 💳 Credit report fee ($25-$50)

Third-Party Fees:

- 🏠 Appraisal ($400-$700)

- 🔍 Home inspection ($300-$500)

- 📄 Title search and insurance ($700-$2,000)

- 👨⚖️ Attorney fees ($500-$1,500)

- 📊 Survey fee ($300-$500)

Prepaid Items:

- 🏦 Homeowners insurance (first year)

- 🏛️ Property taxes (prorated)

- 💰 Prepaid interest (from closing to month-end)

- 🏠 HOA fees (if applicable)

Example: $300,000 Purchase

- Total closing costs: $6,000-$15,000

- Plus down payment: $9,000-$60,000 (3-20%)

- Total cash needed: $15,000-$75,000

Ways to Reduce Closing Costs:

- 💰 Negotiate seller concessions (seller pays portion of costs)

- 🏦 Shop lenders for lower fees

- 📅 Close at month-end (reduces prepaid interest)

- 🔍 Compare title insurance providers

- ❌ Skip optional services (owner's title insurance in some states)

Learning about negotiation tactics can help you save thousands on your next home purchase.

Special Considerations for Gen Z Homebuyers

Gen Z faces unique circumstances that require specific strategies when navigating your best mortgage options: a guide to home financing for Gen Z.

Student Loan Debt and Mortgage Qualification

How Student Loans Impact Your Mortgage:

- 📊 Increases debt-to-income ratio

- 💰 Reduces borrowing power

- 🎯 May require higher income to qualify

Strategies to Manage:

- 📋 Income-driven repayment plans: Lower monthly payments improve DTI

- ⏸️ Forbearance or deferment: Lenders may use 0.5-1% of balance as payment

- 💳 Pay down other debt: Focus on high-interest credit cards first

- 📈 Increase income: Side hustles, promotions, co-borrowers

- 🏦 Choose right loan type: FHA allows higher DTI than conventional

FHA Student Loan Treatment:

- Uses actual payment on income-driven plan

- If deferred, uses 0.5% of balance

- More flexible than conventional loans

Conventional Loan Treatment:

- Uses greater of actual payment or 1% of balance

- Stricter DTI requirements

- May require documentation of payment plan

Gig Economy and Self-Employment Income

Challenges:

- 📊 Irregular income patterns

- 📄 More documentation required

- ⏰ Longer approval process

- 🎯 May need larger down payment

Solutions:

- 📋 Two years of tax returns: Shows consistent income history

- 💰 Profit and loss statements: Current year income documentation

- 🏦 Bank statements: 12-24 months showing deposits

- 📈 Trending income: Show income increasing, not decreasing

- 💼 Multiple income streams: Diversification shows stability

Bank Statement Loans:

- Alternative to traditional income verification

- Uses 12-24 months of bank statements

- Calculates average monthly deposits

- Higher rates but more flexible

- Good for high-earning gig workers

Remote Work and Location Flexibility

Advantages:

- 🌍 Access to affordable markets

- 🏠 More house for your money

- 💰 Lower cost of living

- 🎯 Emerging markets with growth potential

Considerations:

- 📍 Lender may require employer letter confirming remote work is permanent

- 🏦 Some lenders prefer local properties

- 💻 Internet infrastructure requirements

- 🏛️ Property tax and insurance variations by location

Hot Markets for Remote Gen Z Buyers (2026):

- Affordable with good infrastructure

- Strong job markets

- Lifestyle amenities

- Growing appreciation potential

Check out the hottest US cities to move to for location ideas that balance affordability and opportunity.

Co-Borrowing and Co-Signing

Co-Borrowing (Both on Title and Loan):

- ✅ Combined income increases buying power

- ✅ Both build credit and equity

- ✅ Share financial responsibility

- ⚠️ Both liable for full payment

- ⚠️ Affects both credit reports

Co-Signing (On Loan, Not Title):

- ✅ Helps borrower qualify

- ✅ Co-signer not on title

- ⚠️ Co-signer fully liable

- ⚠️ Affects co-signer's credit and DTI

- ⚠️ Difficult to remove later

Common Co-Borrowing Scenarios:

- 💑 Couples buying together

- 👨👩👧 Parents and adult children

- 👥 Friends or siblings

- 💼 Business partners

Legal Protections:

- 📄 Co-ownership agreement

- 💰 Buyout provisions

- 🏠 Exit strategies

- 👨⚖️ Attorney review recommended

First Home as Investment Property

House Hacking:

- 🏠 Buy multi-unit property (duplex, triplex, fourplex)

- 🏡 Live in one unit, rent others

- 💰 Rental income offsets mortgage

- 🎯 Build equity while minimizing housing costs

- 📊 Qualify with owner-occupied financing (better rates)

Requirements:

- Must live in property as primary residence

- Typically need to stay 1 year minimum

- Can use projected rental income to qualify (with restrictions)

- Need reserves for vacancies and repairs

Benefits:

- 🎯 Lower down payment (FHA allows 3.5% on 4-unit)

- 💰 Rental income builds wealth

- 📈 Appreciation on entire property

- 🏦 Tax benefits of rental property

- 💡 Real estate education through experience

Learning about real estate investment strategies can help you maximize returns if you're considering house hacking or future investment properties.

Technology and Tools: The Gen Z Advantage

Gen Z's digital fluency is a massive advantage in the mortgage process. Here are the impeccable tools and technologies to leverage:

Mortgage Comparison and Calculator Tools

Best Mortgage Calculators:

- 🧮 Mortgage Calculator (Zillow, Realtor.com): Basic payment estimates

- 📊 DTI Calculator: Understand debt-to-income ratio

- 💰 Affordability Calculator: Determine price range

- 🔄 Refinance Calculator: Compare refinancing scenarios

- 📈 Amortization Calculator: See principal vs. interest breakdown

Comparison Platforms:

- 🏦 LendingTree: Compare multiple lenders

- 💻 Credible: Rate comparison and pre-qualification

- 📱 Bankrate: Rates and lender reviews

- 🎯 NerdWallet: Personalized recommendations

Digital Mortgage Lenders

Online-First Lenders:

- 🚀 Rocket Mortgage: Fully digital process

- 💻 Better.com: Low fees, fast closing

- 📱 SoFi: Tech-focused, member benefits

- 🏦 Ally Home: Online bank with competitive rates

Advantages:

- ⚡ Faster processing

- 💰 Lower fees (less overhead)

- 📱 Mobile app management

- 🤖 AI-powered pre-qualification

Considerations:

- 📞 Less personal service

- 🏠 May not handle complex situations

- 📍 Limited local market knowledge

AI and Automation Tools

ChatGPT and AI Assistants:

- 💬 Explain mortgage terms and concepts

- 📊 Calculate scenarios and comparisons

- 📋 Generate document checklists

- ❓ Answer specific questions about your situation

Automated Savings Apps:

- 💰 Qapital: Rule-based savings automation

- 📱 Digit: AI-powered savings recommendations

- 🎯 Acorns: Round-up investing and saving

- 🏦 Chime: Automatic savings transfers

Credit Monitoring:

- 📊 Credit Karma: Free credit scores and monitoring

- 💳 Experian Boost: Add utility payments to credit report

- 🔍 Credit Sesame: Credit analysis and recommendations

- 📈 MyFICO: Official FICO scores (paid)

Document Management:

- 📄 DocuSign: Electronic signatures

- 🗂️ Google Drive/Dropbox: Organize documents

- 📱 Genius Scan: Mobile document scanning

- 🔐 LastPass/1Password: Secure password management

Using AI tools for real estate can streamline your entire homebuying journey.

Social Media Research

Platforms for Research:

- 📱 TikTok: Real estate agents sharing tips, market insights

- 📸 Instagram: Property tours, renovation inspiration

- 💼 LinkedIn: Professional real estate insights

- 🎥 YouTube: Detailed tutorials and market analysis

What to Follow:

- 🏠 Local real estate agents in target markets

- 💰 Mortgage brokers explaining loan types

- 🔨 Home inspectors showing red flags

- 📊 Economic analysts discussing market trends

Red Flags to Avoid:

- ❌ "Get rich quick" schemes

- ❌ Unqualified "gurus" selling courses

- ❌ Outdated advice (pre-2020 market)

- ❌ One-size-fits-all recommendations

Common Mistakes to Avoid: Learn from Others' Errors

Even with the best intentions, many first-time homebuyers make costly mistakes. Here's what to avoid:

Financial Mistakes

1. Not Getting Pre-Approved

- ❌ Wastes time looking at unaffordable homes

- ❌ Weakens negotiating position

- ❌ May lose dream home to pre-approved buyer

2. Maxing Out Your Budget

- ❌ No room for unexpected expenses

- ❌ House poor (all income goes to housing)

- ❌ Can't afford furnishings, maintenance, emergencies

3. Ignoring Total Costs

- ❌ Focusing only on monthly payment

- ❌ Forgetting property taxes, insurance, HOA

- ❌ Underestimating maintenance and repairs

4. Draining Emergency Fund

- ❌ Using all savings for down payment

- ❌ No cushion for job loss, repairs, emergencies

- ❌ May face foreclosure if income interrupted

5. Not Shopping for Best Rate

- ❌ Accepting first offer without comparison

- ❌ Losing thousands over life of loan

- ❌ Missing better terms from other lenders

Process Mistakes

6. Making Major Financial Changes

- ❌ Changing jobs during approval

- ❌ Opening new credit accounts

- ❌ Making large purchases

- ❌ Co-signing loans for others

7. Skipping Home Inspection

- ❌ Missing major structural issues

- ❌ Surprised by expensive repairs

- ❌ No negotiating leverage for problems

Understanding property inspections helps you avoid costly surprises after closing.

8. Waiving Contingencies

- ❌ Losing earnest money if deal falls through

- ❌ Forced to buy problem property

- ❌ No exit strategy if issues discovered

9. Not Reading Documents Carefully

- ❌ Missing important terms and conditions

- ❌ Signing agreements you don't understand

- ❌ Agreeing to unfavorable terms

10. Rushing the Process

- ❌ Making emotional rather than rational decisions

- ❌ Overpaying in competitive markets

- ❌ Missing red flags in excitement

Long-Term Mistakes

11. Choosing Wrong Loan Type

- ❌ ARM when planning long-term ownership

- ❌ 30-year when could afford 15-year

- ❌ FHA when conventional would be cheaper

12. Ignoring Future Plans

- ❌ Buying in area you'll want to leave

- ❌ House too small for growing family

- ❌ Commute unsustainable long-term

13. Overlooking Resale Value

- ❌ Buying most expensive house in neighborhood

- ❌ Unusual floor plans or features

- ❌ Poor location within good area

14. Not Building Equity Strategically

- ❌ Only making minimum payments

- ❌ Not considering extra principal payments

- ❌ Missing refinancing opportunities

After Closing: Managing Your Mortgage and Building Wealth

Getting the keys is just the beginning. Smart mortgage management builds long-term wealth.

First Year Homeowner Checklist

Month 1:

- 📋 Set up automatic mortgage payments

- 🏠 File homestead exemption (if applicable)

- 📄 Organize closing documents

- 🔐 Change locks and garage codes

- 📧 Update address with USPS, banks, employers

Month 2-3:

- 🔍 Review property tax assessment

- 💰 Set up maintenance fund (1% of home value annually)

- 📊 Create home inventory for insurance

- 🏡 Complete minor repairs and improvements

- 📱 Research home warranty options

Month 4-6:

- 🔄 Review mortgage statement for accuracy

- 💳 Check credit report for proper reporting

- 🏠 Seasonal maintenance (HVAC, gutters, etc.)

- 📈 Track home value appreciation

- 💰 Evaluate extra payment strategy

Month 7-12:

- 📊 Review homeowners insurance for adequacy

- 🏛️ Verify property tax escrow is correct

- 🔍 Annual home maintenance inspection

- 📄 Organize receipts for tax deductions

- 💡 Plan next year's improvements

Strategies to Pay Off Your Mortgage Faster

Extra Payment Strategies:

1. Bi-Weekly Payments

- Pay half mortgage every two weeks

- Results in 13 full payments per year (vs. 12)

- Saves years off mortgage and thousands in interest

- Example: $300K @ 7% saves $70K and 5 years

2. Round Up Payments

- Round payment to nearest $50 or $100

- Example: $1,896 → $1,900 or $2,000

- Small amount adds up significantly

- Flexible approach without commitment

3. Annual Lump Sum

- Apply tax refund, bonus, or windfall to principal

- Even $1,000/year makes substantial difference

- Example: $1,000/year on $300K @ 7% saves $50K and 4 years

4. Refinance to 15-Year

- When rates drop or income increases

- Higher payment but massive interest savings

- Forced discipline to build equity faster

5. Recast Your Mortgage

- Make large principal payment, lender recalculates payment

- Keeps same term and rate, lowers monthly payment

- Typically $150-300 fee

- Good after receiving inheritance or bonus

Refinancing: When and Why

Good Reasons to Refinance:

- 📉 Rate drop: 0.75-1% reduction typically worth it

- 💰 Remove PMI: Once you hit 20% equity

- ⏰ Shorten term: Switch from 30 to 15-year

- 💳 Cash-out: Access equity for improvements or debt consolidation

- 🔄 Switch loan type: ARM to fixed, FHA to conventional

Break-Even Analysis:

- Calculate refinancing costs

- Determine monthly savings

- Divide costs by savings = break-even months

- Stay longer than break-even = good decision

Example:

- Refinance costs: $4,000

- Monthly savings: $200

- Break-even: 20 months

- If staying 2+ years, refinance makes sense

When NOT to Refinance:

- Planning to move within 1-2 years

- Break-even period too long

- Resetting 30-year clock when you're 10+ years in

- Costs outweigh benefits

Building Equity and Wealth

Equity Building Strategies:

1. Strategic Improvements

- Focus on high-ROI projects

- Kitchen and bathroom updates

- Curb appeal enhancements

- Energy efficiency upgrades

Learn about best home improvements before selling to maximize your return on investment.

2. Proper Maintenance

- Prevents small problems from becoming expensive

- Preserves and increases home value

- Regular HVAC, roof, plumbing maintenance

- Seasonal upkeep prevents deterioration

3. Market Appreciation

- Choose appreciating neighborhoods

- Monitor local development and trends

- Understand factors driving value

- Be patient—real estate is long-term investment

4. Leverage Tax Benefits

- Mortgage interest deduction

- Property tax deduction

- Home office deduction (if applicable)

- Capital gains exclusion when selling

5. House Hacking

- Rent spare rooms (Airbnb, long-term tenants)

- Convert garage or basement to rental

- Offset mortgage with rental income

- Learn property management skills

Understanding real estate investment taxes helps you maximize deductions and minimize tax liability.

Conclusion: Your Path to Homeownership Starts Now

Navigating your best mortgage options: a guide to home financing for Gen Z might seem overwhelming at first, but you now have the knowledge to make informed decisions. The key takeaways? Don't let gatekeeping myths about needing 20% down or perfect credit stop you. Extraordinary opportunities exist through FHA loans, VA loans, USDA loans, and first-time homebuyer programs that can make homeownership accessible right now.

The 2026 housing market presents both challenges and opportunities. Yes, interest rates are higher than the historic lows of 2020-2021, and home prices continue to appreciate in most markets. But waiting for "perfect" conditions means missing out on equity building, tax benefits, and the stability of homeownership. Every month you rent is a month you're building someone else's wealth instead of your own.

Your Action Plan:

This Week:

- 💳 Check your credit score and report

- 💰 Calculate your budget using the 28/36 rule

- 📋 Research first-time homebuyer programs in your state

- 🏦 Identify 3-5 lenders to compare

This Month:

- 📄 Gather documentation for pre-approval

- 🎯 Get pre-approved with your chosen lender

- 📍 Research neighborhoods and markets

- 💡 Start following local real estate agents and market updates

Next 3 Months:

- 🏠 Begin house hunting with clear criteria

- 🔍 Attend open houses and schedule showings

- 💰 Continue saving for down payment and closing costs

- 📊 Monitor interest rates and market conditions

When You Find Your Home:

- ✍️ Make competitive offer with pre-approval letter

- 🏠 Schedule home inspection

- 📋 Work closely with lender through underwriting

- 🎉 Close on your new home and start building equity!

Remember, homeownership is a journey, not a destination. Your first home doesn't have to be your forever home—it's a stepping stone to building wealth and achieving financial independence. Gen Z has unique advantages: technological fluency, access to information, and a willingness to challenge traditional wisdom. Use these strengths to navigate the mortgage process confidently.

The fresh perspective Gen Z brings to real estate—prioritizing flexibility, leveraging technology, and questioning outdated norms—is already changing the industry. Whether you're house hacking a duplex, buying a starter home in an emerging market, or strategically using a VA loan, you're not just buying a house. You're investing in your future, building generational wealth, and proving that homeownership isn't just for older generations.

So based? Absolutely. The data shows that homeownership remains one of the most reliable paths to building wealth. The median homeowner has 40x the net worth of the median renter. Starting early, even with a modest property, compounds over decades into substantial wealth.

Don't let analysis paralysis stop you. You don't need to know everything before starting—you learn by doing. Connect with a trusted real estate professional, get pre-approved, and start your journey. The impeccable feeling of holding those keys to your first home, knowing you're building equity with every payment instead of enriching a landlord? That's worth the effort.

Your best mortgage options: a guide to home financing for Gen Z isn't just about loans and interest rates—it's about taking control of your financial future and building the life you want. The door to homeownership is open. It's time to walk through it.

For more expert guidance on your real estate journey, explore the comprehensive resources at Real Estate Rank IQ, where licensed brokers with over 15 years of experience provide actionable insights for buyers, sellers, and investors. Have questions? Reach out to news@realestaterankiq.com or follow @Realestaterankiq on YouTube for video tutorials and market updates.